That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Great morning. With one, sudden tweet out of President Trump late yesterday afternoon, an astonishing market rally came to a crashing conclusion. A quick stimulation package, constantly remote (for this author anyway ), seems all but dead today. Andwell, This Is the Way the markets felt relating to this information:

U.S. stocks are up this early as I sort, trying to claw back some of ’therefore losses. They’re {} to some {} Trump tweet that perhaps, just perhaps, there may be a sliver of hope for some sort of stimulation measure for the American market.

Caution: Dexamethasone + remdesivir + Regeneron + Chat storms can produce side effects on your portfolio.

Allow ’s see what’s occurring.

Market upgrade

Asia

- The most significant Asia indicators are largely lower in day trading, however Hong Kong’s Hang Seng continues its rallyup 1 percent .

- The international box office is floundering, however maybe not in China. The nation ’s enormous Oct.1 vacation weekend saw film ticket revenue soar to pre-pandemic amounts .

- Anyhow, the information doesn’t seem so promising. Even the IMF cautioned the rally for its international market will probably be more protracted than initially {} , pushing 2021. {

- German industrial output abruptly dropped in August, hurt by a slump in auto production, which ’s weighing {} . |}

- Who just is talking for Britain because it struggles soaring COVID amounts ? PM Boris Johnson or even Rishi Sunak, his fund leader? Both will be progressively on another page concerning how to deal with the outbreak. Adding intrigue: just one, Sunak, is now becoming more popular by the afternoon.

U.S.

- U.S. stocks stage to a positive start. This ’s following the Dow closed down almost 376 points in volatile Tuesday exchange after Trump’s converse to finish stimulation talks. Only hours before, Fed seat Jerome Powell had cautioned that financial spending was required to stop jeopardizing the financial recovery.

- The reply outside Washington into Trump’s {} call-off-the-talks tweet was equally swift.

- At a harshly worded report uttered pictures of this trust-busting times of this first 20th Century, House lawmakers basically known as for its separation of Amazon, Apple, Facebook and Domestic ’s Google, stating the tech giants are abusing their dominant place and snuffing out contest.

- The buck is away {} .

- Crude is down also, with Brent trimming 1 percent reduced.

***

Deadly 3Q in background

Mutual fund managers are all getting struck {} . The development of DIY retail trading, ETFs and other passive investment capital are clobbering their own livelihood. And this newest report won’t assist.

In accordance with BofA, supervisors of active capital needed a 3Q to overlook, which ’s despite enormous gains overall from the economies.

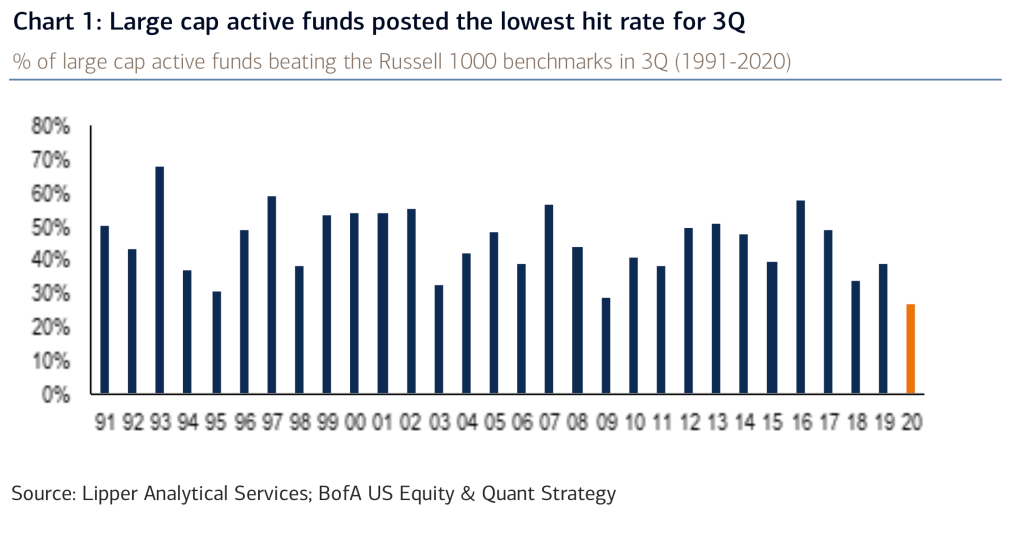

“While US stocks published the very ideal 3Q in ten decades, just 27 percent of large cap active managers beat their benchmarks, representing the cheapest 3Q success rate within our statistics history as 1991,” that the BofA investor notice read.

This ’s exactly everything that 30-year overlook resembles:

The offender, BofA discovered that, was AAPL. Ranked, Apple. Simply speaking, in the event the director of your expansion fund was underweight Apple–there are these expansion funds on the market –then you need to put him on the telephone.

“We compute Development supervisors ’ underweight in AAPL (0.46x grade ) detracted 1.5ppt. the grade at 3Q, throughout which AAPL drove {} of the standard ’s yield,” the report states. This ’s a very long means of declaring a growth fund which didn’t comprise the fastest-growing large cap has been, obviously, doomed to underperform.

Here ’s the fantastic news: “40 percent of funds continue to be forward YTD,” BofA notes, plus they’re above the historic yearly average for the entire year.

What’s, September was really a fantastic month for many busy supervisors, putting them to get a promising Q4.

***

Have a great day, everybody. I’ll visit you tomorrow.

Bernhard Warner

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.