Good morning. It may have been a somewhat subdued, socially-distanced affair in Washington yesterday—LOWEST. INAUGURATION.TURNOUT. IN. MEMORY!, someone somewhere no doubt tweeted—but investors were out there, popping champagne corks.

U.S. equities hit record highs on Wednesday, and today global stocks continue to rally today. Alas, Bitcoin continues to slump.

Let’s see where investors are putting their money.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading with the Shanghai Composite up 1.1%.

- Alibaba investors are doing a bit of profit-taking today, sending shares in the e-commerce giant 2.7% lower. That’s after the company $58.2 billion surge on Wednesday.

- Chinese tech stocks have been on a one-month tear. The Market Ear blog notes, the closely watched KraneShares CSI China Internet ETF (KWEB) is up nearly 25% since Christmas as we see the global tech trade reflate.

Europe

- The European bourses were higher out of the gates with the Stoxx Europe 600 up 0.75%. with auto and bank stocks leading the way.

- The real estate market for London‘s swankiest neighbo(u)rhoods, Mayfair and Knightsbridge, is hitting all kinds of COVID turbulence, forcing landlords and property owners to slash rents and offer prices.

- The Bitcoin market may be stalling out at the moment, BlackRock, the world’s biggest asset manager, will for the first time offer futures in the digital currency to clients.

U.S.

- U.S. futures are gaining again this morning. That’s after all three exchanges, plus the Russell 2000, closed Wednesday in the green, with a string of fresh all-time highs.

- The big winner was Netflix, which jumped 16%. (It’s flat this morning). As Fortune‘s Aaron Pressman explains, perhaps overlooked in all the glee over new subscriber sign-ups is even bigger news— that “the company would be cash flow positive this year despite spending close to $20 billion on new programming.”

- Upbeat corporate earnings has proven a huge tailwind to stocks this week. Here’s who on deck today: CostCo, Intel, IBM and Kimberly-Clark, to name a few.

Elsewhere

- Gold is up a tick, trading above $1,860/ounce.

- The dollar is down a whisker.

- Crude is off a sliver [help, I’m running out of tiny metaphors], with Brent trading below $56/barrel.

- Bitcoin is down 5.3%. A cool three grand has been shaved off its value in the past 24 hours, to $32,700. [No metaphor problem here.]

***

Buzzworthy

Bitcoin bulls are unimpressed

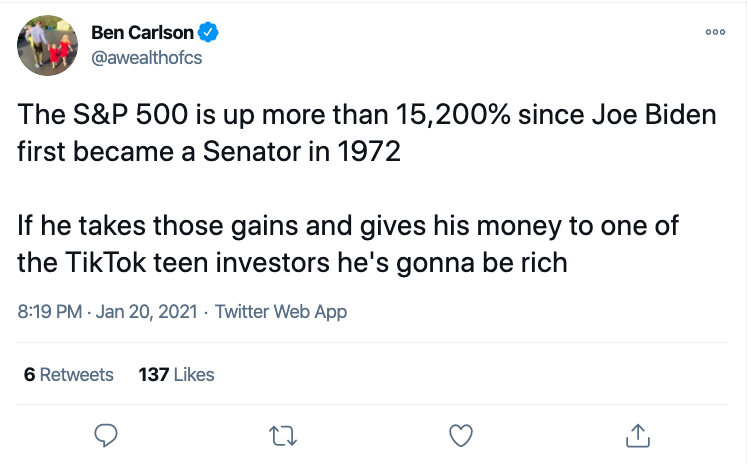

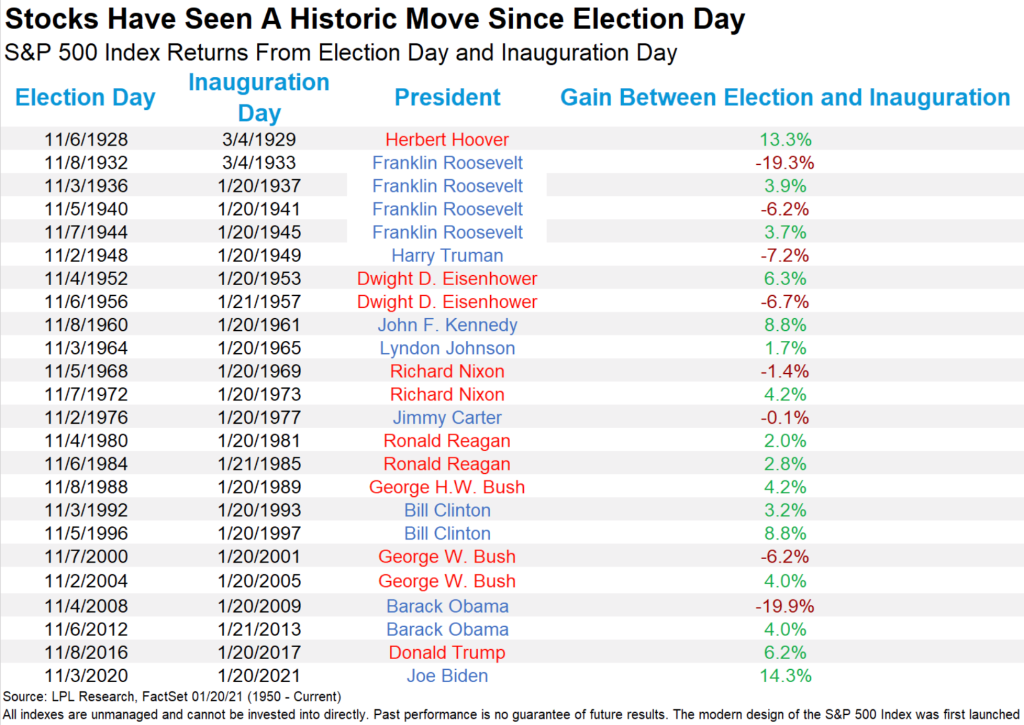

Biden > Trump, Obama

Inauguration party’s over; Who’s got the tab?

For the win

Source: WallStreetBets / Wall St Memes

***

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

[email protected]

As always, you can write to [email protected] or reply to this email with suggestions and feedback.