In stable times, sticking with a proven formula makes sense. For successful companies, it’s a good bet that the products and models that are working well today will continue to work in the future. But in volatile and uncertain times—when the need for resilience rises to the forefront—adapting to new circumstances and reinventing businesses become central challenges.

The events of 2020 have reminded us how quickly the pattern of challenge can change. When the COVID-19 pandemic first swept across the world, companies focused primarily on the immediate problems of how to maintain operations and survive. But as time has passed, business leaders have shifted their attention back to longer timescales, such as what it will take to succeed in the postcrisis future and how to rebuild their businesses accordingly.

Even before the pandemic, however, change and uncertainty were on the rise. That’s why BCG and Fortune created the Future 50 index together more than three years ago. We wanted to identify companies with the greatest capacity to continually reinvent their businesses and sustain long-term growth—what we call corporate “vitality.” The past year has shown that vital companies don’t just survive adversity. They use it to create a competitive advantage.

A proven formula

This is the fourth annual edition of our Future 50 index, which assesses the long-term growth prospects of large public companies and identifies who comes out on top. It is intended as a forward-looking companion to traditional business metrics, which generally show only what has happened in the past.

The index is based on two pillars: a “top-down” market-based assessment of a company’s potential, and a “bottom-up” analysis of its capacity to deliver growth. For the bottom-up view, we have quantified and tested numerous theories about what drives long-term success across four dimensions (strategy, technology and investment, people, and structure), and we use machine learning to select and weight factors based on their empirical contribution to long-term growth.

Our analysis incorporates a wide range of financial and nonfinancial data sources. For example, we assess the growth and quality of each company’s patent portfolio as an indicator of technology advantage. And we define metrics for strategic orientation, such as long-term focus and tendency to serve a broader purpose beyond financial returns, based on natural language processing analysis of each company’s annual reports.

As we have done previously, we screen out companies that have sustained negative operating cash flow, indicating businesses that are highly vulnerable to unfavorable disruptions. We have also stratified our ranking to account for companies that have elevated uncertainties, such as reputational risk or a discontinuity in the direction of the business. (For more on the methodology, click here.)

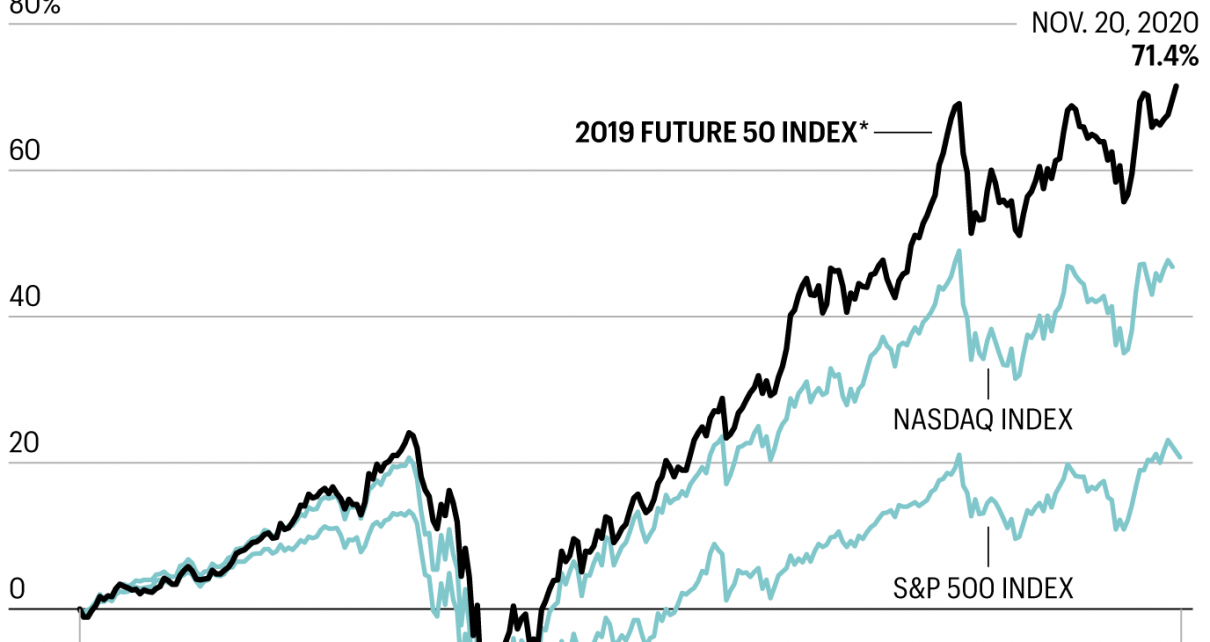

Vitality operates over long time periods, so it will not always be reflected in immediate performance. In particular, one might have reasonably expected highly vital companies to struggle to deal with the COVID-19 crisis, given the short-term nature of the challenges involved. Yet our index has greatly outperformed the market amid the turbulence of 2020—the 50 companies we identified last year have produced a cumulative shareholder return of 71% since publication, compared with 18% for the MSCI World stock index. This demonstrates that vitality is a critical part of sustaining success in bad times as well as good times.

A window to the future

Aggregate patterns in our ranking reveal clues about where vital companies are most likely to be found—and where trends have shifted.

The technology sector is well represented—more than 50% of Future 50 companies are in the IT, communications, or e-commerce industries—but diverging patterns within the industry are visible. On one hand, the acceleration of trends such as digital transformation and online shopping are evident: Seven of our top 10 companies are now B2B software businesses (including No. 1 ServiceNow), and several e-commerce companies across different regions joined this year’s list. On the other hand, many companies that digitally facilitate congregation in the physical world (such as travel or live events platforms) fell out of the ranking.

There has also been a clear shift toward health care, which increased from 12% of last year’s list to 22% this year. Some of these are companies that may directly see demand increase as a result of COVID-19 in areas such as ICU equipment or drug development. Others were hurt in the short term by the postponement of nonessential procedures but still have strong long-term potential, especially in a world where consumers may be more health conscious.

Our ranking points to a bipolar global economy: More than 80% are based in North America or Greater China, in line with recent corporate growth patterns. Compared with last year’s ranking, North America has increased its share slightly (from 56% to 58%), while China’s share has fallen somewhat (from 32% to 24%). However, a deeper look shows that this divergence is likely driven by the dynamics of select companies and industries (such as real estate and premium liquor); when expanding our list to the top 200 companies, we find that the relative share of Chinese and U.S. companies is roughly unchanged from the prior year.

Our index once again demonstrates that diversity is a key ingredient for long-term success. Diversity data is difficult to find publicly, but one consistently reported aspect is gender diversity. While still far from achieving true gender equality, highly vital companies have more diverse executive teams than their peers—women represent at least one-quarter of leaders at 50% of Future 50 companies, compared with 24% of others—and our analysis also shows that gender diversity among the entire employee base is a predictor of growth.

Finally, even though some segments are better positioned than others, highly vital companies can be found in all sectors and geographies: Our list spans five continents and includes not just tech giants but education, restaurants, and construction-materials companies. In other words, vitality can be achieved everywhere—and even amid a crisis, opportunity awaits companies that are willing and able to look to the future.

Martin Reeves is a senior partner at management consulting firm BCG and chairman of the BCG Henderson Institute. Kevin Whitaker is head of strategic analytics at the BCG Henderson Institute.

A version of this article appears in the December 2020/January 2021 issue of Fortune with the headline, “Finding advantage in adversity.”

More stories from Fortune’s print edition:

- 2020’s Most Powerful Women in Business

- How the secretive CFIUS became a powerful weapon in the trade wars

- Dis-United States of electricity: Mapping America’s energy supplies

- This ace engineer powered Amazon through the COVID crisis

- Telling men’s stories through their cars