But they also declared the firm ’s continuing struggles to provide the market with all its namesake disinfectant wipes–mentioning it not only after , but no more than 20 times.

It’s ’s reasonable to say that racing to replenish shops together with all the wipes, that were flying off shelves at the U.S. as February as soon as the COVID-19 epidemic began, is still a Clorox obsession nowadays. And the firm has really mobilized funds up 10 additional providers in order to not lose out on a revenue bonanza that may endure for weeks longer. However, the snowball has additionally compelled Clorox to determine how to benefit from this crisis to {} execute its multiyear road map{} the firm hailed before anybody had heard of this novel coronavirus.

This ’s certainly one of the excellent challenges confronting Rendle, that formally took the reins past month. “Where can we go from here, and just how can we leverage what’s a chance to serve numerous individuals around the globe, not only using our disinfecting goods but using our wide portfolio? ” Rendle asks rhetorically at a dialogue with Fortune.

Rendle, 42, began in Clorox in 2003 following a year or two in competing Procter & Gamble, which makes her way up from the positions until more lately overseeing Clorox’s home cleanup enterprise. In 2019, to check whether the rising superstar was CEO substance and might invent a significant company plan, Clorox’s plank along with then-CEO Benno Dorer tasked Rendle with coming up with all the firm ’s {} multiyear growth program. That campaign resulted in Rendle drafting her “Ignite” road map, also delivered a year ago, as a followup to Clorox’s seven-year “2020 Strategy” plan, that finished last year.

The objective of Ignite would be to create 2%-4% in yearly earnings growth for the upcoming few decades, a bit over what Clorox had handled beneath its preceding strategy , and no simple feat in a market where goods fast become commoditized and drop pricing power. That might indicate introducing new goods, in addition to upgrading existing ones and simplifying Clorox’s achieve in new classes.

Rendle’s Ignite plan dazzled the Clorox plank and finally got the Harvard- and also Stanford-educated executive appointed president earlier this season, putting up her to succeed mentor, Dorer, that currently serves as executive chairman. (Rendle’s ascent also brought her a place on this season ’s “Ones to View ” listing for Fortune‘s Best Women in company.)

Some companies like its own vitamins branch were hurt by provider problems, along with Clorox has been penalized by retailers past winter for increasing the costs on its own Glad garbage bags, decreasing shelf space at the procedure.

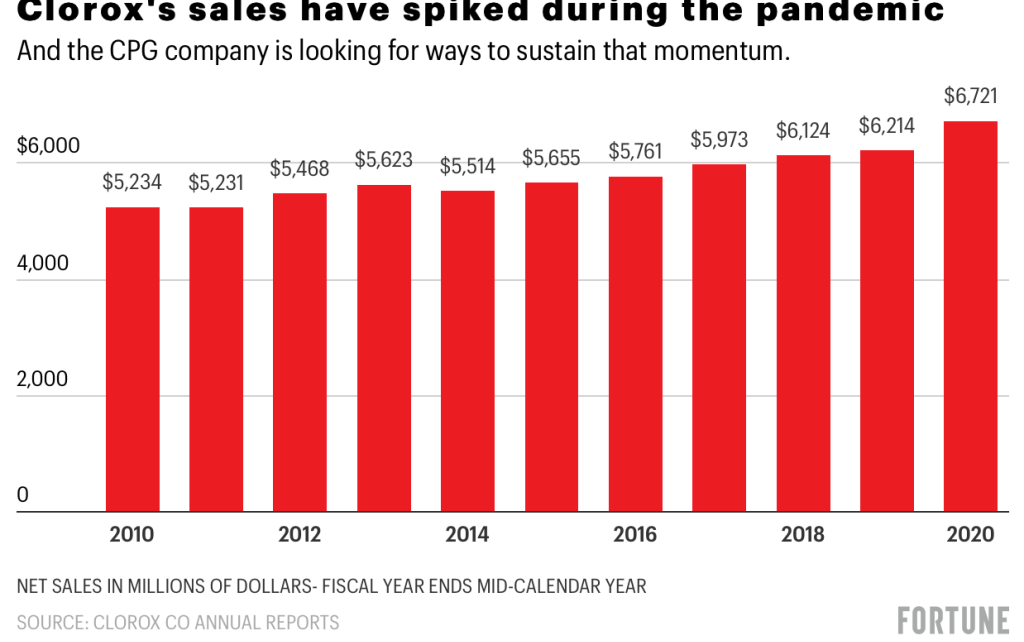

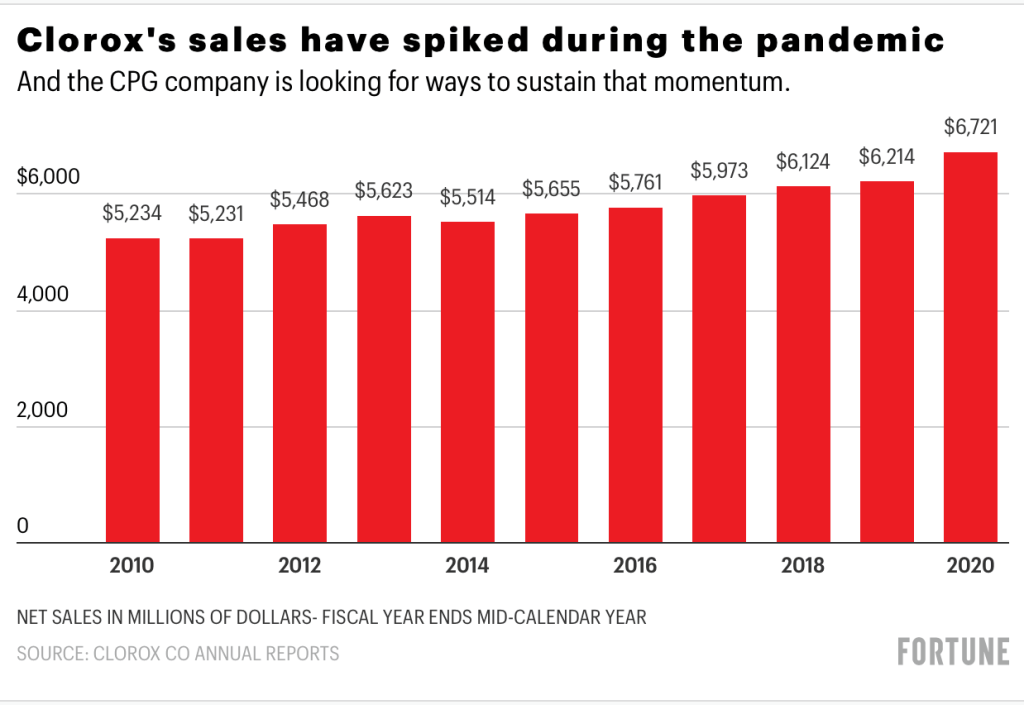

However, the COVID catastrophe has shipped Clorox company earnings through the roof, together with customers bulk-buying and hoarding any cleanup goods that they could find. The blessing to Clorox’therefore firm has dropped: Total earnings climbed 22% year over year at the firm ’s fourth quarter. And for its financial year ended June 30, Clorox earnings hit $6.7 billion, up 8 percent from 2019, the firm ’s greatest annual gain in over a decade. The business remains tiny in comparison to P&G, whose earnings topped $70 billion. However, Clorox’s {} are up 42 percent up to now in 2020.

It’s not only wipes or disinfectants forcing the expansion, possibly. Lots of folks cooking at home has fortified Clorox’s lately {} Kingsford charcoal manufacturer. An explosion in pet adoptions will be assisting its kitty litter enterprise. And folks are more worried about germs in public areas in addition to in the home. The question is how to leverage most of this attention in Clorox’s merchandise to keep momentum, something which will hinge on continued to think of new goods.

“Innovation is the lifeblood of the business,” Dorer stated in a meeting this summer.

Should you’re trying to find an illustration of Clorox’s longstanding culture of invention, look no farther than the wipes now selling like hotcakes. The wipes came into market in 2000 when the company was hoping to determine the way to provide consumers an easier way to use soap. Fast-forward to {} , as well as also the wipes anchor Clorox’s cleansing company, a supply of almost a third of business earnings and its main component.

Clorox needs invention to maintain in a cutthroat class. Consumer packaged goods (CPG) manufacturers like P&G, Unilever, Lysol-maker Reckitt Benckiser, along with Kimberly-Clark are engaged in an arms race with the business. On Tuesday, P&G reported its largest quarterly revenue profit within 15 decades, although Reckitt posted record development. What’s, retailers such as Target and Walmart are ramping up their shop brands. The merchandise lines at the CPG class are hotly aggressive, and gain margins, currently reduced, shrivel immediately once a new grows rancid. Thus Clorox’s invention must go {} a couple tweaks here and there.

“You’ve must have the ability to arrive at the table with a lot much more persuasive than a line expansion. ”

Not every invention needs to become revolutionary. Clorox was able to reinvigorate its own grilling firm with relatively easy adjustments, such as introducing wood pellets for grills along with supplying charcoal which lighting quicker. Its Glad trash bags firm has gotten a boost from the inclusion of compound elements that provide the bags a odor; the provider also produced the totes more powerful by integrating new resins which are environmentally friendly.

“These things matter for customers,” states Rendle, that notes it’so important to perform what she predicts “small-i invention ” and “big-I creation. ” “Should you’re overly focused on {} the huge invention, your center [product line] over the years isn’t quite as important to customers,” she adds.

And that’s been Clorox’s ethos for quite a while. Earlier lately, Clorox switched into its Hidden Valley Ranch salad dressing table, a fresh it purchased in the 1970s, by a byproduct product right to some $600 million manufacturer through strategic moves like adding bites. A latest product upgrade: its Burt’s Bees personal-care branch will be incorporating cannabidiol (CBD) to your products that autumn. Brand-new products currently generally take just 14 weeks to become from first concept to advertise in Clorox, in comparison to 24 weeks before.

Innovation adds roughly three percentage points into Clorox’s earnings increase each year, Dorer states, meaning that with no Clorox earnings will be stagnant. And also to strengthen an innovative culture, Clorox retains periodic creation “hackathons.

Rendle says creation isn’t only at the item level: It may take the kind of quicker procedures, simplifying merchandise variety to accelerate creation of bestsellers, or squeezing out generation and supply efficiencies to increase gross profits –something CPG organizations are pursuing.

“The fact is that the business has needed to be effective in this catastrophe,” states Geoff Freeman of Consumer Brands Association, a trade group, of Clorox and its peers.

Beyond new products and line extensions, Clorox is gambling it can find much more mileage from its current lineup.

Display A: disinfecting merchandise. 1 place wide open with fresh chance is the specialist marketplace, such as offices, hotelsand hospitals, and anyplace outside the house. That section makes up only 7 percent of business sales at current, also Kimberly-Clark is powerful there, however, analysts see tons of upside down for Clorox. Before this season, Clorox signed prices by United Airlines, Uber, along with AMC movie theaters to present Clorox-branded things to those businesses. The prices assist the company capitalize on individuals ’s aversion to germs and the high name recognition that the pandemic has contributed its own products, such as its namesake wipes along with other lines in its own arsenal such as Pine-Sol and 409.

“As customers reenter public spacesthey wish to be assured their distance is as clear as if they left house,” states Rendle. “And also a great deal of commercial cleaning companies aren’t known to customers. ” That idea, naturally, brings her back into a more instant preoccupation. “The sole limiting factor at the moment is furnish,” she states.

A Wholesome firm

CPG firms such as Clorox and P&G have been “portfolio businesses ” that have regularly odd sets of disparate goods. Clorox, which began life in 1913, may likewise be regarded as a hodgepodge: The roster contains Liquid-Plumr, Brita water filters, and also New kitty litter.

About 14 decades back, a more recent attention for Clorox started to emerge: health-focused merchandise. The new accent began with Burt’s Bees organic personal-care goods and lasted 2010 if Clorox dropped traces such as STP engine oil. Ever since that time it has included lots of {} health-oriented goods, such as antioxidants and vitamins, most especially using the $700 million purchase two years ago from Nutranext, also a new dietary supplements.

“We’re a health and wellness company in mind,” states Dorer. “Wellness is the basis of the business, helping people keep their property safe. ” However, it’s a popular place and one where Clorox can compete nicely.

Clorox’s key sauce when constructing new companies is to prevent taking on larger competitions such as P&G head-on. Rather the provider goes into particular regions where it could be a market leader and goals to construct a great business without needing to perform a huge turnaround occupation onto a faltering brandnew.

“What makes them special is how they’re moving into merchandise and classes where they could be No. 1 or No. 2, and they back up that with invention,” states Lori Keith, a portfolio director in Parnassus Investments whose midcap fund retains $100 million value of Clorox stocks and targets on ESG investments. “They’ve chosen their spots independently. ”

Clorox entered the nutritional supplements and nutritional supplements through acquisitions, and it aims to keep developing the enterprise. However, Rendle claims that on her view, Clorox will keep its long-held coverage of not performing mergers and acquisitions to the incorrect reasons, just to find itself saddled with failing companies which drain funds. It will help that M&A isn’t hauled into Clorox executives’ settlement.

“We all do space-driven M&A, maybe not banker-driven M&A,” clarifies Dorer. For Clorox operators, which usually means focusing on new locations, becoming experts by themselves, rather than needing investment monies induce ill-advised deals in groups too much neater. M&A is your “cherry to {} ” of a thriving firm, Dorer states.

For the time being, Rendle gets her plate full, what’s providing an insatiable economy with Clorox wipes at the long run, but alive up to the goals that she put on in the Ignite strategy.

“The error a great deal of businesses make is that they don’t understand themselves well enough,” ” she states. Clorox, she’s, is still great at creating brands, so making supply chains more effective, and discovering ways to secure more applications from present products. “The secret sauce {} this is being focused on the heart,” states Rendle.