S&P gains have careened in good, to dreadful, to beginning a small comeback. Would liftoff from here put stocks on a great run, or can prospective earnings fall short of Wall Street’s amazing expectations, leaving stocks overpriced and thanks to get a sharp selloff?

Earnings season kicks off this week using eagerly-awaited reports from J.P. Morgan, P&G, Johnson & Johnson, UnitedHealth, along with Delta Air Lines one of two dozen columns of their S&P 500. Investors are relying heavily on a solid showing in Q3. A series of “defeats ” from the days ahead could show that momentum is now building to propel large cap gains well over their all-time summit set only last year. How else can Wall Street merit, in defiance of this COVID-wracked market, compelling now ’s valuations to this gold zone, also asserting the super-rich costs granted a Tesla, PayPal or Apple make great sense?

It’s fairly apparent in 2019, gains were unsustainable. On the flip side, it’s also clear that the pandemic has delivered them into a cellar in which they won’t remain for long. For investors overwhelmingly confused about if stocks are a fantastic purchase or outrageously costly, here’therefore the only real question: When the market evolves, where are earnings likely to pay for?

Its operating earnings as a share of earnings dropped 11.1percent, much above the 9 percent grade in December of 2010 into the beginning of 2017. To put it differently, the 500 profited out of a confluence of all tradewinds that place earnings on a far more rapid path than in previous decades. Chief among these: a market running hot in about 3 percent over several quarters, and salary that lagged the powerful expansion in earnings.

At precisely exactly the identical time, what traders paid for every dollar of earnings sprinted. In the conclusion of 2019, the 500’s price-to-earnings multiple stood in 23.2. This doesn’t seem dangerously large versus background. But remember the lofty evaluation came in addition to super-high EPS, attained on peak of the benefit cycle.

The pandemic took earnings from fine to dreadful. The 500’s EPS dropped from $35.52 at Q4 of $2019 to a gigantic $11.88 at Q1 and $17.83 at Q2. The catastrophe pushed salvation way under the standard selection, and valuations much over the long-term markers. Normally, working margins dropped more than those six weeks to 7.8percent, as according to earnings swung from good to less-than-mediocre. In precisely exactly the identical time earnings plummeted, the S&P 500 bridged March’s profound valley to gain 10 percent over the year’s near. The mix drove the P/E into 37 in line with the previous 3 quarters and analysts’ predictions for Q3. This ’s amount that within the last 3 decades, was only surpassed at the 2001-2002 bubble,” and also overdue 2009, once the fiscal meltdown totaled earnings.

What’s where gains settle when the market returns to normal in 2021 or 2022, and also the P/E investors award these gains. The CAPE supplies a solid, durable revenue figure {} a 10-year typical of inflation-adjusted gains that removes both the peaks and troughs, like the summit in 2019 and the COVID-canyon of both Q2 and Q3 of the year. The CAPE includes a downward bias as it utilizes a decade-long typical that doesn’t fix earnings for any expansion beyond rises in the CPI. Since EPS on average climbs by a few points per year over inflation, it’s ’s better to increase CAPE earnings by 10 percent to acquire a “renewable ” amount for 2020.

Bumping the 108 by 10% leaves earnings-per-share of 120. This ’therefore the best quote of where gains will probably stabilize when GDP returns to the prior trajectory of 2 percent, state at late 2021 or premature 2022. If really earnings slow to an yearly rate of 120, the S&P will be reserving $30 per year. This ’s 14% under the $35 rate in 2019.

It’so notable the analysts resisted by S&P are calling EPS of 28 in Q3. This ’s a 112 at an yearly pace, just 7 percent under our “up-to-date” amount of 120. Indeed, as stated by the S&P statistics, earnings of $28 per quarter would create operating earnings of 9.8percent, nearer to the amounts from 2010 to 2016, until the enormous spike in adulthood. Consequently, the best option is that gains increase from the Q3 markers of 28 by less than 10 percent to approximately $30 (approximately even $120 annualized). To put it differently, the stunt has got the air from earnings in only months which may have taken much longer, however, was {} . With this investigation, we won’t find anything even near the rampaging earnings rally Wall Steet anticipates.

What if the share price? In the end on Monday, October 13, the S&P struck 3534, only 1.4percent off its all-time large attained in early September. Thus by our reckoning, the S&P is placing an 29.5 multiple on its own {} future gains. Since 1990, its P/E has averaged 21.8; within the previous 60 decades, the standard is a far thinner 16.9.

Let’therefore presume a sunny situation where the numerous drifts back into the 30-year grade of about 22. If that’s the situation, an S&P 500 indicator would endure at 2616 ($120 slowed by 21.8), or even every share of the S&P 500 Co. will be worth 2616. This ’s 26% under its worth now, however 17% greater compared to the nadir of March 20.

Investors could be capricious, however, the marketplace ’s mathematics is a stubborn thing.

Much more must-read fund policy out of Fortune:

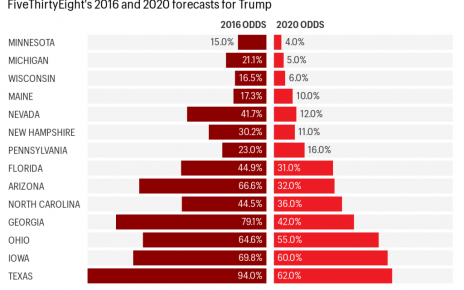

- Everything Wall Street wants in the 2020 election

- Why it seems like we are in a downturn –although we are not

- Businesses with more happy employees outperform their peers

- Biden “gloomy tide ” would improve market , states Goldman Sachs main economist

- Boris Johnson needs young Brits to Purchase houses –even if that means banks need to give like it is 2006