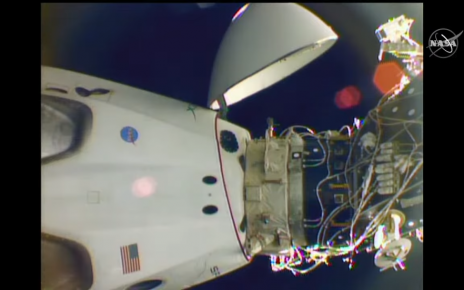

(credit: Dave Rutt )

Two Democratic lawmakers introduced a new bill on Wednesday that would institute a host of new regulations to scrutinize mergers, including a prohibition of those valued at more than $5 billion.

The Prohibiting Anticompetitive Mergers Act , sponsored by Sen. Elizabeth Warren (D-Mass. ) and Rep. Mondaire Jones (D-N. Y. ), would also prevent mergers and acquisitions that would increase market share among sellers and buyers beyond certain thresholds and would give regulators additional tools to unwind mergers.

While the $5 billion threshold may capture headlines, this bill is perhaps most notable because it attempts to limit companies’ dominance in the labor market, too.