Good morning.

It’s another day of choppy trade in stocks, oil, and in Bitcoin. U.S. futures have been up and down all morning as voters head to the polls in Georgia to determine control of the U.S. Senate and what that will ultimately mean for more stimulus spending and for American tax policy and its regulatory climate.

In today’s essay, I look beyond voting day to assess which sectors stand to gain in 2021.

But first… let’s check in on what’s moving the markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading with the Shanghai Composite up 0.7%.

- Shares in China Mobile popped nearly 7% on Tuesday after the New York Stock Exchange pulled an about-face, saying it won’t be delisting the firm, or two other China telcos, after all.

- Qantas Airways is betting international travel will come back by this summer. The Australian carrier has begun taking reservations on July flights to Hong Kong, Singapore and Japan (that’s good news for Tokyo 2021 organizers), and for London flights in October.

Europe

- The European bourses are choppy in early trading. The Stoxx Europe 600 was down 0.3% at the open amid fears that a new wave of business- and school-closings will stifle an economic comeback for the region.

- The FTSE was trading higher on Tuesday morning despite a round of tough new lockdown measures going into effect across England.

- The long awaited merger between Fiat Chrysler and PSA Group to form the world’s fourth largest carmaker cleared a series of crucial shareholder votes on Monday, sending shares in both companies briefly higher. (The new company will be called Impavid Motors… kidding… It’s Stellantis, a moniker derived from the Latin verb stella, or, “to cover with stars.”)

U.S.

- U.S. futures are slightly to the upside this morning. I know. I said something similar, and then U.S. stocks bombed shortly after the opening bell.

- The S&P 500 closed 1.48% lower on Monday, after recovering in late trade. At one point, the benchmark index was at risk of pulling off its worst start to the year since 2001.

- All eyes will be on the Georgia run-off election today. Polls show it’s a dead heat. In an investor note yesterday, Goldman Sachs outlined what’s at stake, saying, “if Democrats manage to win both of the Senate seats in play in Georgia…this would lead to greater fiscal stimulus—we would expect around $600bn more on top of the recently enacted $900bn—but would also likely mean tax increases to finance additional spending.” Any tax rise, they add, would be on the small side.

Elsewhere

- Gold is flat, trading around $1,945/ounce.

- The dollar is off a touch.

- Crude is up, with Brent futures trading above $51/barrel as lockdown measures again weigh on the energy market.

- Bitcoin trade remains volatile. The digital currency, as I type, is now at $30,835, 10% off its Jan. 3 all-time high. That’s despite JP Morgan issuing a bullish call of Bitcoin topping $146,000 in the long-term.

***

Looking back to glimpse the future

To get a better indication of the year ahead, it’s worth taking a second look at what happened last year—specifically, at Q4 of 2020.

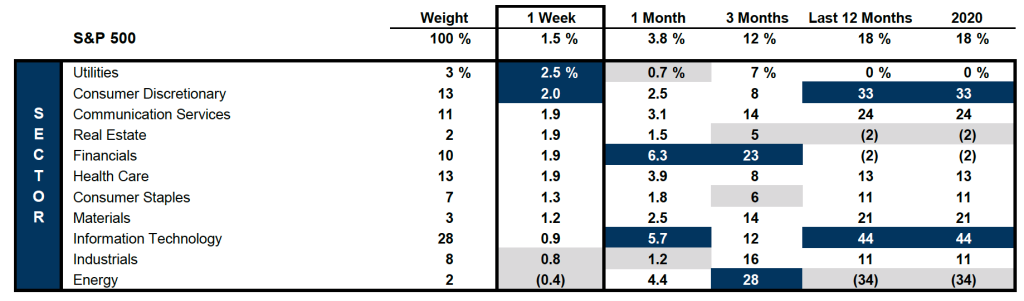

On a full-return basis (which factors in dividends), the S&P 500 climbed 18% in 2020, Goldman Sachs calculates, largely on the back of a surge in tech stocks.

But tech stocks have played only a secondary role in the very significant post-Election Day rally. The big drivers of late have been energy (up 28% in Q4), financials (up 23% in that period), and industrials (+16%). Each of those sectors outperformed the S&P as a whole in the final quarter of the year. The Goldman chart below breaks this down further:

Now, nobody is saying the tech trade has run its course. Companies and consumers will continue to invest heavily in tech—both hardware and software—in good times and bad. And, as long as interest rates remain at these near-zero levels and inflation remains a distant prospect, that cycle of investment should continue well into the future.

But growth stocks, which as a category comprises tech, are much pricier than the likes of value stocks such as financials and industrials. And so investors are betting there’s greater return to be had by rotating out of the work-from-home trade and into the recovery trade. That’s certainly been true since November, around the time health officials signaled they’d give the green-light for the first batch of COVID vaccinations.

Looking forward to the year ahead, Goldman predicts the S&P will finish 2021 at 4,300. That’s 16% above yesterday’s close, which, incidentally, would be “twice the 8% average annual return since 1930,” Goldman notes.

For such a rally to happen, more sectors would need to participate. In other words, look to Q4 2020 for your cues on how we get from 3,700 to 4,300.

***

Have a nice day, everyone. I’ll see you back here tomorrow… But first, there’s more news below.

Bernhard Warner

@BernhardWarner

[email protected]

As always, you can write to [email protected] or reply to this email with suggestions and feedback.