Our assignment to generate business better would be fueled by viewers just like you. To enjoy unlimited access to our own journalism, subscribe now .

Brian Brooks, America’s leading banking regulator, has a concept to help close the prosperity gap between developed and developing world. He calls the idea”country coin”

Exactly what exactly the generic-sounding suggestion lacks in tricky branding it constitutes in substance. The crux of this program is to encourage education and economic development globally, says Brooks, the U.S. Acting Comptroller of the Currency. Since greater literacy levels correlate to greater”gross domestic item,” afterward incentivizing people to keep their instruction could improve productivity, person well-being, and social wealth, he states.

These kinds of rags-to-riches fundamentals are well recognized in the academic literature, even when their execution lags in training. (Only ask the World Bank’s economists.) Nonetheless, it’s the character of Brooks’ special incentive system which may strike people. The perfect inducement? Cryptocurrency tokens, he states.

Under the strategy, world authorities would reward individuals with so-called state coins for continuing learning. A student earns money by completing online classes and passing examinations. The coins could basically reflect statements on a”trust fund” set up from the country; they’d entitle recipients to prospective payouts symbolizing a share of their increasing tax revenue produced by increased GDP.

Translation: as individuals get more schooling, states, state coin-earning pupils, and shareholders get wealthier together. The cryptocurrency guarantees everybody gains, instead of just individuals who property great salaries at the job market after completing their studies.

“That is a method of growing equity and raising expansion without increasing taxes without pitting the rich against the poor,” Brooks says.

Unsure about his very own high view of this program, Brooks stated:”I’m telling you why this ought to be another Nobel Prize. It’s {} idea.”

Brooks directed into Afghanistan, Southeast Asia, and Latin America as being one of the ripest areas where state coin may have the greatest effect. “There’s no technical reason why this couldn’t occur immediately,” he explained.

What is required is to get labs”to realize this as a comparatively lightweight, non-interventionist, non-us-against-them strategy approach to allowing everyone get wealthier collectively, and that’s exactly what the growing world needs to need,” Brooks continuing.

Bryan Hubbard,” Brooks’ deputy comptroller for public affairs, shared with an exclusive trailer of an account his group intends to launch that clarifies the nation coin proposition in detail. Brooks coauthored the paper together by two former coworkers in Coinbase, the largest U.S. cryptocurrency market, where he had been formerly chief officer.

“In consequence, the coins turned into a quasi equity stake in the nation since it signifies a forecast regarding the rise of future cash flows,” ” states the newspaper, whose cowriters comprise Hermine Wong, Coinbase’s chief of staff to hope and danger, along with Amy M. Luo, Coinbase’s senior counselor for international business growth and “stablecoins,” some kind of cryptocurrency that’s intended to keep a constant price.

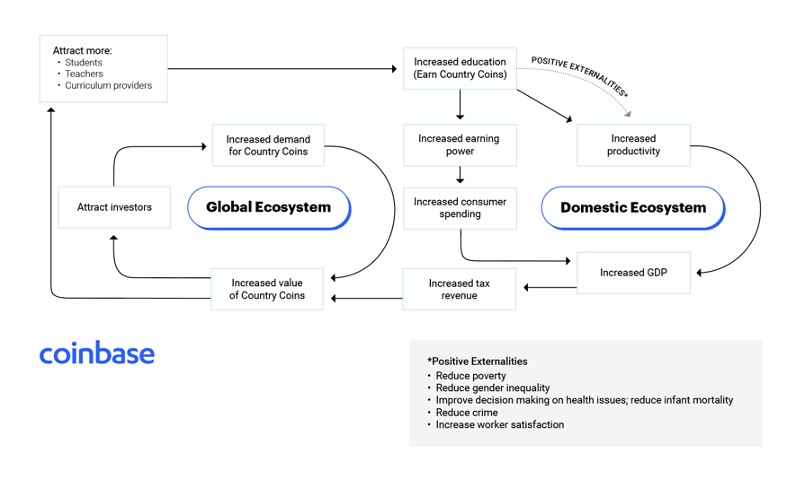

A flowchart found from the “nation coin” newspaper describing a economical “flywheel impact ” which may lead to linking instruction to equity across the world.

In practice, this usually means that a student can take virtual classes employing a mobile phone and get, as compensation, Colombia coins in the country ’s fund ministry. When the coins will be worth 10 dollars each piece in the right time of disbursement, subsequently making 100 coins will return $1,000 immediately. Assuming Colombia’s GDP and taxation base increase as time passes, and then the purchase price of the coins may be expected to increase in price also, making more for your recipients.

“A virtuous flywheel cycle is made where the longer students learnthe more precious the coins turn into, and need for the coins (and consequently their value) grows as more students take instruction classes,” the newspaper states. The proposal covers socioeconomic inequality”in a sense conventional tax policy hasn’t,” the subjective declares.

Universal fundamental schooling

The thought can be regarded as a sort of universal standard revenue –with a twist.

Rather than distributing a fixed quantity of cash to individuals simply to be tax-paying taxpayers, state coin could benefit {} who research and understand the most. They’re, after all, the ones that are directly advancing domestic results in health, professions, societal equilibrium, and GDP.

The preferred discipline does not matter; if a person research A.I. programming or programming literary concept makes very little difference. “GDP growth is influenced by the doctrine academics, not as by the applications engineers,” Brooks says. “The best thing about the strategy is the employment markets may {} you differentially, however everyone shares in domestic wealth creation. We’re all in it together”

Some states are currently experimenting with types of global basic income. Tests have happened at Brazil, Kenya, Switzerland, along with Finland, in Addition to U.S. states like Alaska and California. At the U.S., the notion gained more grip following previous Democratic presidential candidate Andrew Yang embraced it since component of the campaign stage . Cryptocurrencies are suggested for its purpose also.

Comptroller of those (Crypto-)money

Brooks was shaking the Office of the Comptroller of the Currency since he joined earlier this season. Hallmarks of the tenure include awarding more banking charters into financial technology , or fintech, startups, vocally supporting cryptocurrency invention . , and pushing to get a controversial “honest accessibility ” to banking solutions principle .

A few members of the advanced wing of the Democratic Party have criticized Brooks because of committing, they state, an excessive amount of attention and time to the cryptocurrency market. By comparison, he’s earned plaudits in the private industry because of his regulatory strategy , for example by means of banks have been allowed to maintain deposits financing stablecoins.

Brooks, a former general counsel of the mortgage Fannie Mae, is anticipating a confirmation hearing for an potential last-minute term because the nation’s leading bank regulator following his appointment from President Trump into the interim part in May. If Brooks has verified, President-elect Joe Biden might –and, really, very well may –eliminate him out of the function to put in a hawkish ruler of his choosing.

“Finance could be a push for real change and actual great on earth,” Brooks says. “Developing a permission-less nation coin in nations on increase trajectories from developing to developed status is among the greatest ideas in finance now.”

Much more must-read tech policy out of Fortune:

- Commentary: The Facebook along with Google antitrust lawsuits are a warning shot for Most corporate giants–not only Enormous Tech

- Why Intuit purchased Credit Karma in among the greatest fintech bargains of 2020

- U.K. startup’s breakthrough may help quantum computers from the search for exotic substances

- Tom Siebel, CEO of C3.ai, discusses collapse and the future following his firm’s soaring IPO

- Shopify is ready for the holiday period.