Vlad Tenev, just like a lot of CEOs nowadays, is operating from house. A slim 33-year-old using jet-black hair down to his back, Tenev has combined a movie call to talk about how his firm Robinhood, manufacturer of the very popular eponymous stock-trading program –intends to capitalize on its current expansion.

But he has other alterations on his thoughts. A father of 2, Tenev clarifies his younger kid is in the last stages of potty training–a landmark that feels particularly important given Tenev’s very own sanity. “So that there was enormous pressure to proceed from diapers.”

Although he {} in tony Palo Alto, Tenev brings his youth experience with Communism often, invoking the financial hardships and deprivations the machine imposed. In his opinion, the failures of Communism affirm Robinhood’s über-capitalist assignment, which will be to assist rookie investors build wealth by purchasing stocks.

Its slick app-based attributes have made it the most go-to investment platform for most individuals under 40. Its fast rise has driven incumbents to emulate its own creations, most especially zero-commission trading, that practically all agents currently offer. And its simplicity of usage along with unabashed cheerleading for shares also have made it synonymous with a brand new species of investor called the”Robinhood dealer”–a cohort disparaged by several financial experts, but one that sway is currently reshaping assumptions about how exactly to make investments.

For Tenev along with also his 35-year-old cofounder, Baiju Bhatt, long-term victory –such as profitability along with a general public offering–is determined by guiding those dealers toward affluence. Robinhood considers it could emulate what Schwab failed two generations before, obtaining younger clients that the remaining portion of the sector has disregarded, then supplying more profitable financial solutions as those clients older.

With this approach to work, nevertheless, Robinhood has to prove it could reach maturity. The business’s stumbles on technology implementation, regulatory compliance and client support have prompted doubt about its capacity to provide advice and products to wealthier customers. Other critics also have faulted the Menlo Park, Calif., startup for boosting speculative trading. As Tenev wrangles toddlers in the home, he will have to bring subject to a business {more {}|more likely} to acting like a hormone-addled adolescent.

Enrolling for Robinhood may feel as navigating a idle mobile video sport. Exuberant screens guarantee,”There is free inventory waiting” Others provide a”Robin’s benefit” electronic scratch-and-win ticket–that in my situation deposited $3.24 value of a vague healthcare inventory into my brand new account. Over 10 seconds, I managed to exchange stocks and stock choices. It is a quantum jump from the previous time that I opened up a brokerage accounts, five decades back. That process required days, included fax machines, also, of course, provided no scratch-and-win awards.

I have since undergone the layout that Robinhood utilizes to promote trading. Flurries of alarms arrive, unbidden, to alert me to cost moves in shares I have. (I get regular pings relating to this healthcare inventory.) While I do something fresh, an onscreen confetti shower frees my transfer.

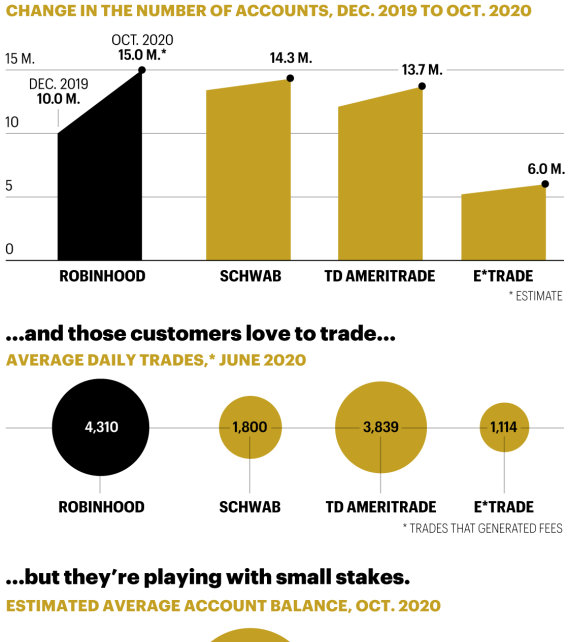

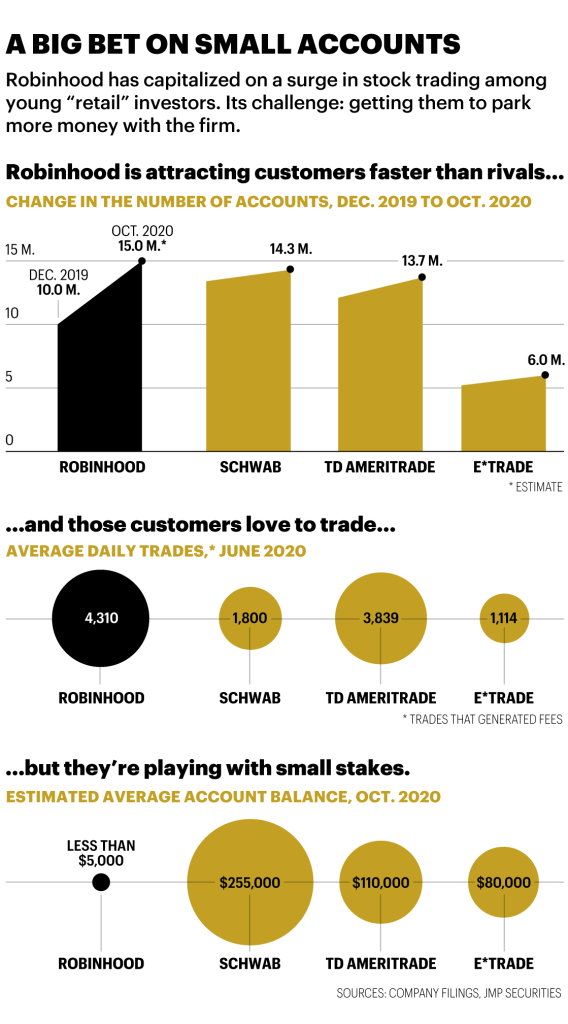

In the next quarter, its customers exchanged almost 60 million shares of stock, a 150 percent year-over-year growth, eclipsing prices at Schwab and E*Trade. Back in June, the start-up its competitors for the very first time on a broadly viewed metric known as daily average revenue transactions, submitting an average of 4.31 million, half a thousand over runner-up TD Ameritrade.

Robinhood’s dominance isn’t a fluke. It captured up by deploying the perfect technology at the perfect moment: It started in 2013, as smartphones became omnipresent. The set worked over Robinhood’s port, instructing themselves typography and iOS layout whilst driving Caltrain commuter rail and fine-tune the program by requesting millions of strangers to test it. In addition they pulled the startup hint of devoting premature clients to consult with friends, making buzz with no cost of a {} effort. It did not hurt their Stanford group comprised a who’s who of prospective Valley moguls, such as Snapchat founders Evan Spiegel along with Bobby Murphy, Instagram’s Kevin Systrom, also press gadfly and enterprise investor Josh Constine, that could function as the duo’s casual brain trust.

Robinhood also used customer-acquisition tactics which other brokerages had rarely attempted. Commission-free trading has drawn most attention but equally significant was needing no minimal investment, which intended customers with hardly any money could instantly assemble stock exchange stakes.

Its approach is more reminiscent of San Francisco–established Charles Schwab, the prior upstart which created stock trading available to smaller shareholders from the 1970s with lesser commissions and everyman advertising campaigns. Incumbents chose a dismissive opinion of Schwab, says Chip Roame of Tiburon Strategic Advisors; heavyweights such as Merrill Lynch allow Schwab hoover up little investors whether they beamed to”priority families” with much more resources. “Today, Schwab has four times as many customers since they were captured by them while they might,” states Roame. “That is what Robinhood is performing.”

Five years later, the routine might be copying itself–dismissiveness comprised. In interviews, executives in old brokerages praise Robinhood’s program but state uncertainty that the business may offer the advice customers will need. “Gamification and confetti may acquire new dealers in the doorway, but traders require a good deal more out of a company they trust with their cash,” states Barry Metzger, SVP of education and trading at Charles Schwab. “The program is only 1 portion of it. ”

In annually of unprecedented fiscal shocks, number were more sudden than the tide of international investors–investors investing out of private accounts–which sloshed to stocks from 2020. That jump is 1 reason the typical daily volume of shares traded jumped out of seven billion in 2019 about 11 billion annually.

Tenev and Bhatt’s firm has contributed to this growth, so much so that”Robinhood dealers” is now disparaging shorthand for investors that pile into shares with regard for company principles. And really, Robinhood users aided gas bubbles in stocks of broke brand names such as Hertz and J.C. Penney. However, Robinhood insists that caricatures of its clients are unfair, which many goal to purchase and maintain stocks–acting like shareholders, instead of dealers.

Robinhood clients are younger compared to the market standard, using a median age of 31; 70 percent are millennials or even Gen Z. They are even more ethnically varied. As per a poll Robinhood commissioned, 60 percent of the clients are white, compared to 78 percent in other brokerages. Percent of Robinhood consumers are Hispanic, 10 percent are Asian, and 9 percent are Black–amounts near the makeup of their U.S. as a whole. (Ladies remain underrepresented at Robinhood and its competitions, accounting for approximately a third of clients.)

This youthful clientele could possibly be buying shares, but they are not creating much riches however –not in Robinhood. Robinhood declines to comment on this quote, but when true it is a far cry from the rivals: The normal equilibrium in Schwab, for example, is $255,000. However, Robinhood executives state that their youthful clients have another way of investment compared to earlier generations–which Robinhood’s tools can suit their requirements nicely as they get more resources.

Schwab has four times as many customers [as elderly opponents ] since they caught them whenever they can. That is what Robinhood is performing.

Chip Roame, Tiburon Strategic Advisors

{Affordable, low-maintenance index funds and ETFs have been the democratizing force in {} in the 2000s and 2010s. |} However, Howard Lindzon, an {} Robinhood backer and creator of investing website Stocktwits, states that lots of young investors prevent index funds–that could own controversial resources such as tobacco or oil stocks–and rather buy stocks of brands that they trust, such as Netflix and Disney. {Tenev, meanwhile, notes {} fractional shares of stocks that are pricey such as Google and Amazon is especially attractive to this creation. |} During Robinhoodthey could arrange to automatically buy semi shares of these blue chips each payday.

These à la carte strategies do not give the protection and diversification against danger that index funds. However, together with zero-commission trading, establishing a portfolio by purchasing dozens or hundreds of individual stocks is not any more cost-prohibitive. And clients who favor funding and ETFs can still purchase them Robinhood. Whatever strategy they use, Tenev says that he expects more customers will guide automatic paycheck deductions in to Robinhood accounts, exactly the manner savers perform with IRAs and 401(k)s. That’ll help keep them in the fold because they grow wealthier, so offering Robinhood an chance to market them lucrative services and products.

Robinhood executives are tight-lipped on exactly what those services and products will be when they will arrive. However, Tenev informs Fortune who Robinhood could finally take a more active part handling clients’ assets, along with also a 2019 deck concerning the business’s future describes strategies to provide IRAs, mortgage financing, and land and life insuranceplan “When you find the merchandise roll out, it is going to fit right into a coherent longterm storyline,” states Tenev.

People who understood Tenev and Bhatt in Stanford say the set were much more bookish than boorish. Tenev says private wealth hasn’t been their principal motivation–notwithstanding {} probably turn into billionaires if Robinhood moves people. “We wanted to become math or mathematics academics,” states Tenev. “You do not do this because you need money”

For Robinhood, this criticism has prevailed about its gamified, casino-like layout and its own business model. And in the stadium of options trading, the mix of these factors has set together the startup on the defensive.

Robinhood earns greater than 70 percent of its earnings through a procedure referred to as”payment for order flow” or PFOF, which created $453 million to its startup at the first 3 quarters of 2020, according to securities filings. (The rest of Robinhood’s revenue comes mostly from financing securities and out of Gold, a 5-a-month premium service that whose attributes include gross profit trading and more-detailed marketplace information ) PFOF entails routing client transactions through market-making companies, in exchange for a commission; the marketplace producers benefit by making cash on the spread between bid and ask prices whenever they implement the transactions. Routing orders market manufacturers may also help clients get more positive prices in their transactions, but it is generally an either/or proposal; when the broker receives a PFOF commission, then the consumers will not get cost improvement.

While contentious, PFOF is trivial: Larry Tabb, a markets analyst in Bloomberg Intelligence, notes PFOF prices are what enable brokerages to provide absolutely completely free transactions at the first location. The problem is murkier, however, when it has to do with PFOF for alternatives –contracts that provide investors the right to purchase or sell stocks at a predetermined cost in the long run. Alternatives provide alternative techniques to gain from share-price moves, however their pricing could be fiendishly complex, and trading these is generally the state of professionals. Market manufacturers offer substantially greater PFOF payments for alternatives transactions, in part because they produce higher margins–and also options-related fees accounts for 62 percent of Robinhood’s PFOF earnings, in accordance with Piper Sandler.

Not only, Robinhood’s program often reminds users that choices are an alternative. Within my test-drives (even later I picked”I understand what I am doing” during signup ), hitting”exchange” on any inventory called a big”Trade Options” button that looked over the more pedestrian”Buy” or”Sell” options. Choosing”Trade Options” contributes to invitations to pick calls and places –the simplest contracts–but also to attempt exotic”multi-leg” approaches involving several contracts, together with titles such as”straddle,””strangle,” along with”Iron Condor,” strategies that would not seem strange in a pro-wrestling match.

These nudges irk critics, who say that the choices game is just one novices should not play, not because experts are able to make the most of novices’ inexperience. Ranjan Roy, a former Bank of America solutions dealer, wrote a broadly shared article describing why experts consult with amateurs”the sausage.” “Should you trade choices daily, you are likely to drop money,” Roy informs Fortune. Benn Eifert, founder of the investment fund which uses alternatives to ride out market volatility, also states that effective options trading demands complex software and significant math proficiency. He expresses dismay within Robinhood’s interface that is tempting. “It is absolutely shocking to me {} not a significant legal problem on them,” he states.

Read an excerpt in Jeff John Roberts’s coming publication, Kings of Crypto, here.

Robinhood hasin reality, been penalized by both sector team FINRA along with the SEC for lack of transparency regarding its PFOF clinics around choices. And evaluation of the way that it promotes alternatives trading has improved in the aftermath of the June passing of a few of its clients, that left a note blaming the company for allowing him collect more than 700,000 of cash whilst trading choices. (It later appeared the 20-year-old had neglected to realize that the adverse balance he found onscreen was considerably higher than his real debt)

Most individuals aren’t longing to get a phone to customer service. They do not wish to speak with a broker. They simply need the fastest solution for their problem.

Vlad Tenev, CEO, Robinhood

Robinhood has promised to reevaluate its own choices platform and also to provide much better disclosure about PFOF clinics and much more educational content for dealers. Tenev claims that tales about options trading do not reflect the customs of the majority of clients: Just 13% commerce alternatives, and over 2% of these attempt multi-leg strategies. Others attached to Robinhood are much less apologetic, watching condescension from the criticism. “There is a shocking amount of elegance in the order stream,” says an executive in one of Robinhood’s market-making spouses. “It is not like it is Aunt Millie in Nebraska trading calls and puts.” Lindzon, the ancient Robinhood backer, admits that some clients make lousy decisions–but asserts that it is paternalistic to prevent them. “You are likely to allow a child drive a vehicle or purchase a Juul, however you are not likely to allow a child decide what inventory they are likely to purchase?” he asks.

Other people relations scratches have dented Robinhood’s standing, as have specialized meltdowns that abandoned consumers not able to access the website during peak trading times. From mid-July of the calendar year, Robinhood had become the topic of 473 complaints to the Federal Trade Commission, in comparison with 126 for both Schwab and 69 for Fidelity–that have equal numbers of consumers. The discontent has been inundated by Robinhood’s way of client support. Unlike conventional brokerages, which area armies of brokers to maintain customers’ palms, Robinhood doesn’t supply customers with a telephone number, making them to look for assistance via the program.

Tenev seems to have internalized the technology credo that automated alternatives are preferable to this conservative (and costly ) option of hiring people. “Many individuals are not longing to get a call to client service,” he states. “They do not wish to speak with a broker. They simply need the fastest solution for their problem.” However, in a bow to reality and for its future aspirations, Robinhood is hiring numerous representatives to staff call centers in Arizona and Texas. The business says that these representatives are currently making outbound calls in reaction to electronic requests for aid –but it does not have any immediate plans to print a telephone number.

Robinhood’s awkward adolescence has not prevented it from increasing very grownup amounts. Back in September, the business announced it had raised $660 million into a new financing across from prominent venture capital companies such as Andreessen Horowitz and Sequoia Capital. After two earlier rounds this past season, Robinhood has increased $2.2 billion in total, with a recent evaluation of about $11.7 billion. The gusher of money amounts to a wager that Robinhood may question or even reevaluate the older defender.

It’s also a wager that Tenev is prepared to conduct a public firm. (Bhatt will stay on Robinhood’s plank and also work on product creation ) Tenev is studying history to discover leaders. “This courage and boldness is motivational. Alexander was on his own horse and moving to fight while his generals were {} .”

The pandemic-driven spike in trading has generated a larger pie for many agents: TD Ameritrade and E*Trade lately published record quarterly trading earnings (every had PFOF as a way to thank). Nevertheless, Robinhood’s advancement stands out: Investors’re downloading its own program at a speed 10 times as good as those of competitions.

However, impressive scale does not ensure Robinhood will develop into a Fidelity or Charles Schwab. Those firms’ varied, rewarding revenue streams comprise asset management and banking services, in addition to interest earned from clients’ accounts.

$11.7 billion

Robinhood’s evaluation on the private marketplace

Assembling a similar suite of solutions in Robinhood will require some time and cash –and it is no sure thing that present customers will adopt them. Many market-watchers guess that lots of investors utilize Robinhood for amusement, wagering little amounts on its own zippy platform when retaining the majority of their prosperity elsewhere. Robinhood’s little account sizes give authenticity to that concept. “Lots of individuals use it like a secondary broker –such as a drama accounts,” says Casey Primozic, that runs a website named Robintrack that encrypts data regarding the very well-known stocks around Robinhood. (Robinhood ceased sharing information with Robintrack in August, in part since the website’s users comprised hedge funds scan for trading routines that they can gain from.)

Financial risks Involved, meanwhile, because of many agents. And charge for order flow, Robinhood’s key artery, can itself be in danger. Tabb, the Bloomberg Intelligence analyst, also anticipates that stress from consumer advocates will probably direct the SEC to take brokerages to show costs otherwise for its”odd lots” which contain numerous retail transactions. Those modifications would narrow down the bid-ask distribute on these transactions –damaging market manufacturers’ margins and earning more earnings for PFOF. Tabb claims such alterations, together with ferocious rivalry, may finally even lead brokerages into reimpose commissions, even undoing the age that Robinhood descended in.

However, for the time being, Robinhood proceeds to maintain its real revenue-generating plans near the vest, as even since it catches customers in a breakneck speed.

The probability of Robinhood turning these dealers to profit-generating, long-term clients looks uncertain–particularly given that the incumbency and bubbles of its own rivals. “That logic, the Walmart ought to really be kicking Amazon’s buttocks, CBS ought to be wiping the floor with Netflix, GM ought to be blowing off the corn from Tesla,” he states.

A variation of the report appears from the December 2020/January 2021 issue of all Fortune using the headline,” “Stealing (market share) in the wealthy: Robinhood’s {} experience. ”

However, to turn into profitable, Robinhood might need to woo more customers from well-financed competitions.