Our assignment to generate business better would be fueled by viewers just like you.

David is providing Goliath a struggle this month.

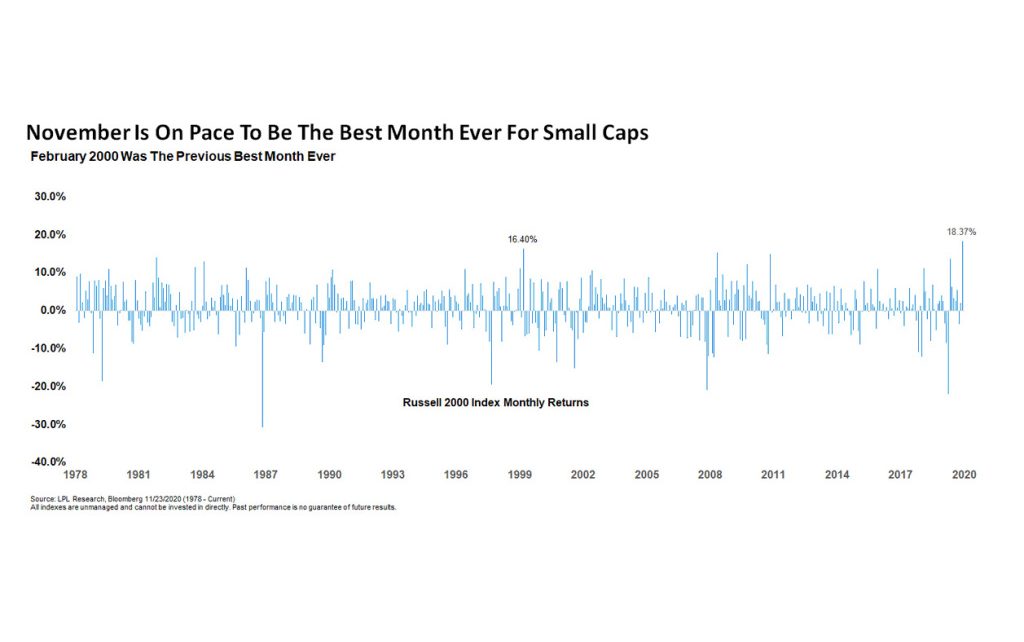

When most investors are mainly concentrated on the larger indices (that the Dow, the Nasdaq, the S&P 500), the Russell 2000 index is gently putting documents. In accordance with LPL’s Ryan Detrick, it’s up 18.4percent for the month, its very best performance actually .

Detrick composed in a notice yesterday that entire, post-election conditions seem marginally “frothy” throughout the marketplace ’s extensive rally. “Participation hasn’t yet been restricted simply to big cap stocks.

However, the Russell’s rally will say more about the wellness of the inherent market than most investors recognize. Erik Sherman clarified the energetic in a bit for Fortune past spring. He wrote that although the Russell 2000 is much less widely viewed as many different signs, it could presage broader economic trends–either on down the road, and also the way upward.

If you’re searching for hints on where the markets are led, “a bunch of analysts, consultants, and investors stage to the Russell 2000, that includes small-scale and midcap companies, so significant to monitor. The Russell has frequently presaged an accident, or blow-off shirt , also around the opposite side of a bear market signaled when circumstances were turning positive,” he composed.

There are some reasons for this. To begin with, since Nathan Moser senior vice president and portfolio manager of the Pax World Small Cap Fund advised Sherman, little caps are focused, using 80 percent of the earnings of the indicator coming in the U.S., versus roughly 40 percent for its S&P 500. This creates the Russell much more vulnerable to U.S. GDP growth compared to other indices.

When problem is vain, small caps generally get less access to financial assets to weather rough time, along with a briefer business cycle. “Consequently, once the market is turning right into a downturn, we’ll observe negative signs from stocks initially, including earnings and profit reductions, growth, and even rust,” Dr. Tenpao Lee, also a professor of economics in Niagara University, wrote in a notice to Fortune. “He pointed out that Russell-type firms are somewhat more flexible, so that they can and will create quicker alterations like laying off workers, making economical changes more evident compared to slower large companies. ”

These forces have been reversed as the market turns the corner from a recession,” Sherman explained. “Subsequently, when items actually turn about (versus a short term bulge, followed by a different autumn ), stocks around the Russell often guide the large-caps. While this occurs, it lets you know ‘investors are going back to the riskier regions of the stocks marketplace,’ Wantrobski explained. ”

Surely the Russell’so moves this week–and also general shift in opinion –would be a welcome sight to investors that, a few six months back were anticipating an protracted downturn or a melancholy .

In the end, because Detrick quipped in his notice, “Nothing affects opinion such as cost. ”

” Kohl’s CEO on the COVID storm