Happy Thanksgiving really.

{

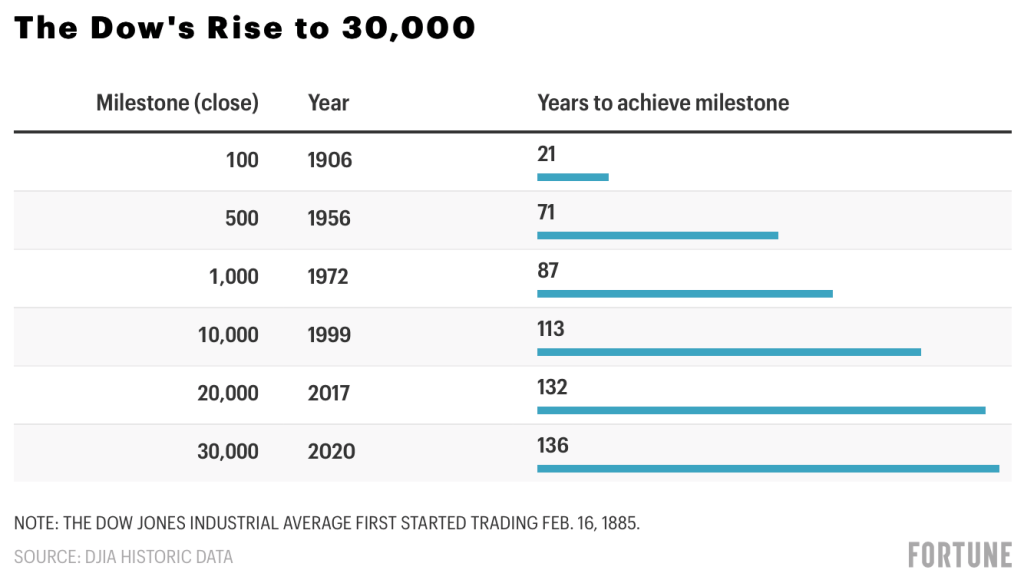

The Dow Jones Industrial Average crossed the 30,000 threshold for {} time Tuesday, capping an astonishing run in the depths of this pandemic last spring once the index churns out only above 18,000. |}

Investors were feeling positive about three fronts. To begin with, disease prosecution was flowing Monday with the statement a third offender from AstraZeneca was around 90% successful . Second, news Monday the Government Services Administration, that was stalling the transition in the incoming Trump Administration into the incoming Biden Administration, could start its official lobbying procedure , came as a relief for people who had feared that an elongated transition-of-power catastrophe.

And lastly, yesterday’s news that Biden had been poised to mention Janet Yellen Treasury secretary was likewise greeted warmly by Wall Street. Not only is she really a stable hand–somebody that the Washington Post known as “that a battle-tested pioneer that aided the state recover from the wonderful Recession”–she’s regarded as a supporter of government stimulation. Additionally a few on Wall Street had emphasized that a more innovative option could have roiled the stock exchange and preferred deeper regulation.

Ryan Detrick, Chief Market Strategist for LPL Financial composed in a note Monday which “The response from shares because the US election was really remarkable. Even the S&P 500 Index is up 8.8percent to the entire month, on speed to be the finest November for its S&P 500 within 40 decades. Small caps also have jumped, with the Russell 2000 Index upward 16%, that could function as second-best month. Though we stay top-of-mind bullish on demographics, there are a number of indications that opinion could be receiving a bit frothy right now, which may increase the likelihood of a pullback. ”

The runup in small cap stocks was cool, together with that the Russell 2000 on course for the very best month . That specifically is a signal, say many analysts, the underlying financial situation are on the fix, provided the indicator increased sensitivity to fluctuations in GDP and the financial cycle.

However, spiking COVID instances along with the approaching Thanksgiving vacation really are a worrisome background to this exuberance in the stock exchange. In actuality, economists in Goldman Sachs recently reduced their GDP quotes because of this. “The lender mentioned ‘the fast and broad-based resurgence of this coronavirus’ because the primary reason it had been downgrading Q4 and Q1 GDP predictions. ”

This ’s reason some bearish investors aren’t confident we’ll remain at those levels. James McDonald, CEO of Hercules Investments at Los Angeles wrote in a notice Tuesday his company is currently preparing to get a 20% stock exchange pullback between now and the inauguration, he finds considerable danger in {} COVID-19 instances, lasted election doubt and the probability of insufficient financial stimulation from Congress.

“Even though Dow 30,000 is a symbolic time for the stock exchange, it’s just a continuation of this marketplace ’s euphoria following the pre-election selloff. In the conclusion of the afternoon, Dow 30,000 is only a number and also the landmark doesn’t maintain some credence in specifying the near-term stock exchange standpoint,” McDonald writes.

Much more must-read Fund policy out of Fortune:

- Hyped for decades, hydrogen is now having its second

- The cashless market: The Way fintech is coming the future of fund

- “Challenger banks” are available to get a record year even as company model remains unclear

- “We’re making it up as we moved. ” Kohl’s CEO on the COVID storm

- What companies slammed by the stunt could hear from America’s winner auto salesman