In ordinary times, the possibility of needing to announce a little fall in earnings is sufficient to create an executive group perspiration. However, that type of setback pales compared to the losses which supply-chain disruptions routinely sabotage –and that is without taking into consideration enormous outlier events such as the COVID pandemic.

However, for decades, many businesses, cautious of broadening efficacy from the immediate period, place off the preventative measures that may minimize the effect of disruptions in the long run. The pandemic has once more pushed home the requirement of handling operational and supply-chain threat –and it’s catapulted these problems to the surface of CEO plans. The sudden needs to be considered likely, and at the very least a baseline amount of anticipated losses from disturbance ought to be inserted into financial preparation. This info can help businesses make better choices about how to spend in supply-chain equilibrium. Our analysis suggests that a typical large firm could spend around 45% of a single year’s gains in strength steps and come out ahead more than ten years. That investment may render”just-in-time” systems {} for”in the event” eventualities.

Disruptions are somewhat more frequent and intense

It is not merely a figment of the collective stress: The world {} riskier. Changes in the environment and in the worldwide market are increasing the frequency and size of supply-chain shocks.

Dozens of climate disasters annually cause harms exceeding a billion bucks every –and also the economic toll brought on by the many intense events has been slumping, since Hurricane Laura along with the California wildfires are demonstrating once again. Even a multipolar world with clashing economic methods is generating greater transaction disputes, including tariffs, along with doubt. The share of international trade conducted {} rated in the lowest half of their planet for political equilibrium, as evaluated from the World Bank, has climbed from 16% in 2000 to 29% in 2018, and 80% of commerce flows through nations with decreasing political equilibrium scores. As businesses become more reliant on electronic systems, they’re also more vulnerable to cyberattacks. Interconnected supply chains and international flows of information, fund, and individuals provide more”surface area” for danger to permeate, and ripple effects may travel round these community structures quickly.

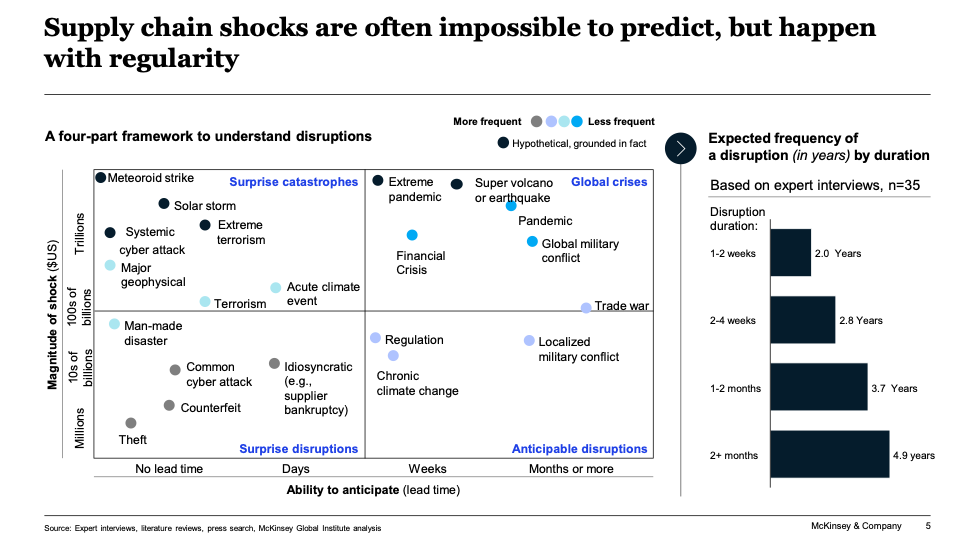

Their answers were surprising: Each 2 years attracts a jolt that halts production and supply for one or fourteen days. More prolonged events additionally arrive around more often than could be anticipated. Producers can anticipate disruptions lasting one or two weeks to happen every 3.7 years typically, and people dragging on for 2 weeks or more every five decades or so. Lengthy international supply chains provide actual perimeter developments, but occasions of the frequency need to be completely accounted for as a true expense of doing business with this type of construction.

Businesses are already attuned to a kinds of risk just because they experience them {} . Information breaches, theft, and industrial injuries occur, and producers have functions and systems set up to attempt and avert them. Trade disputes, also, have dominated the headlines lately, causing some multinationals to change their geographical footprint.

Other kinds of shocks might be infrequent events, but they are able to inflict much larger losses and will need to be on the radar display too. They comprise intense weather, earthquakes, fiscal emergencies, leading terrorist attacks, and also, yes, even pandemics. Some calamities the planet has prevented thus far, like a cyberattack on foundational international systems, needs to be a part of scenario planning. In case 2020 has taught us anything, it is the folly of supposing that intense situations won’t ever come to pass.

Not every business or business is vulnerable to these possible shocks to the identical level. In certain sectors, providers are heavily focused in one geography because of specialization and economies of scalebut a natural catastrophe or localized battle in that area of earth can lead to critical shortages which snarl the whole network. Industries like cell phones and communication equipment are becoming more focused in the past few decades, while some, such as medical devices and aerospace, are becoming much less so. In general, we see that value chains using the maximum commerce intensity and export immersion are far more vulnerable to shocks than other people. They comprise a few high-value and sought after businesses, including communication equipment, computers and electronic equipment, and semiconductors and parts. But, labor-intensive worth chains like clothes are susceptible to pandemics, heat pressure, and flooding risk. Each one these value chains have been ripe for changes to various countries as firms concentrate on durability and policy makers reconsider what’s vital to national financial security.

Within the course of a decade, most companies can anticipate disruptions to divert half a year’s worth of earnings at minimum

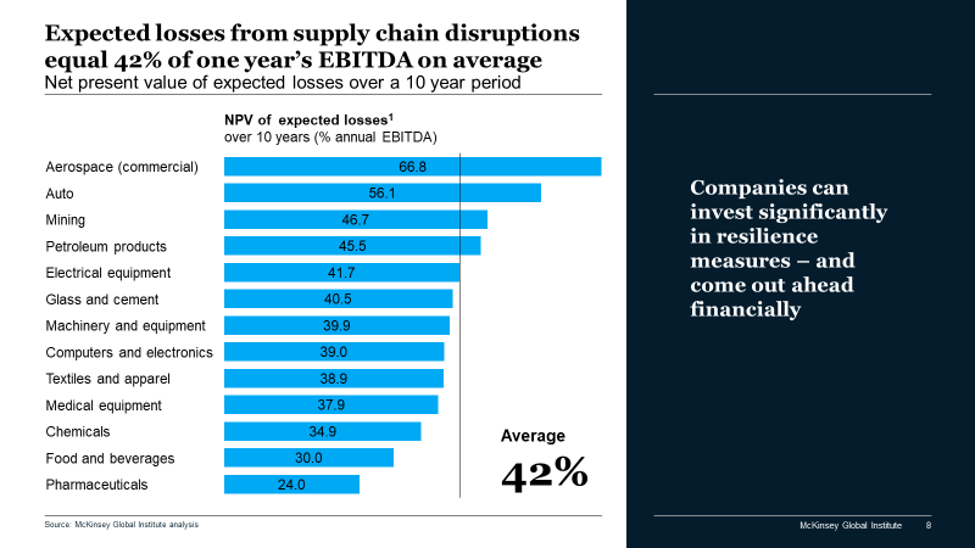

We assembled agent income statements and balance sheets for both hypothetical businesses in 13 distinct businesses, using real data in the 25 biggest public firms in every. We then place them through a pressure test to find out what sort of fiscal reductions a 100-day shutdown will create. Modeling an instance of the seriousness might appear intense, however one research discovered that at 2018 alone, the most tumultuous supply chain events changed over 2,000 websites worldwide and required factories 22 to 29 months to recuperate.

Our situations demonstrate that one prolonged production-only jolt would wipe away between 30 and 50% of a single year EBITDA for businesses in most sectors. [1] An occasion which also disturbs distribution stations will induce the declines sharply higher in certain sectors.

This information makes it feasible to estimate that a minimal bottom-line impact providers can anticipate over the span of a few years, depending on the probabilities and frequency of event. The effect vary across sectors, but typically, businesses can expect to reduce nearly 45 percent of a single year’s earnings over the span of a couple of years. These figures don’t include the extra expense of rebuilding ruined physical resources or even the destruction of customer value, which might persist for a while following the shock.

These are the recurring and hidden costs of conducting business with sophisticated supply chains within a riskier world–and they’re just the baseline. Catastrophic events like the COVID pandemic may inflict far more damage to the most important thing, making losses which some producers might not have the capacity to resist.

There’s a flip side, yet. Individual businesses might have the ability to turn outside shocks in to lemonade. Others might grab on a catastrophe, innovating fast and efficiently under stress in a way that propel development over the very long run.

A newfound admiration for danger is prompting companies to behave

Practical approaches for creating supply chains more resilient and transparent are extensively discussed for decades. However they do need making lasting investments or even accepting a marginally higher cost of products. Because of this, just a little group of top firms had taken decisive action prior to the pandemic struck.

But change is brewed. McKinsey surveyed 60 international supply-chain executives May 2020. An overwhelming 93 percent reported they intend to take action to create their supply chains resilient–and half of these were prepared to prioritize endurance over short-term adulthood. Overall, 53% of respondents intend to market their provider system by qualifying more sellers and building from redundancies. Forty-seven percentage plan to carry more stock of crucial inputs. Forty percent strategy to near-shore their distribution base, also 38 per cent plan to regionalize it.

Stability might be emerging as a crucial metric for measuring corporate performance. Resilience might be a new component thought alongside ecological impact and societal function as investors and clients evaluate companies.

In general, we estimate that 15 to 25% of international goods trade, value between $2.9 and $4.6 billion in 2018, can change to various nations during the next five decades because of a mix of organizations shifting their supply chains and authorities taking action to improve domestic production.

However, there are lots of different means to deal with risk that past altering the physical area of manufacturing and shifting to new providers. The pandemic has happened in a period when tech is leapfrogging ahead into the age of Business 4.0–and developing supply chain transparency via digitization can increase growth and durability concurrently.

Digitization allows visibility into who provides your providers and place vulnerabilities concealed deep at the lower tiers of the community. 1 aerospace firm that undertook this endeavor discovered that it had been sole-sourcing 20 distinct parts from sub-tier providers; identifying this permitted them to buy better deals with opponents and eliminate this possible bottleneck. After the COVID outbreak broke, Nike’s digitized distribution chain allowed the organization to rapidly change products led for brick-and-mortar shops to e-commerce satisfaction centres in China. Consequently, it reduced the strike {} at a time when its rivals continued much bigger strikes.

Some businesses have made it a point to simulate prioritized hazards, but they’ve frequently done so by studying those shocks as different events. Now analytics programs allow a more complex approach that quantifies dangers in the context of wider and more integrated situations. This makes it feasible to combine intense one-off occasions with untoward results and the continuing business cycle, so taking correlations into consideration. Scenarios may also incorporate a variety of risk-mitigation approaches to check which will be {} . The outcomes might then inform strategic planning and funding allocation choices.

Preparing for prospective hypotheticals occasionally has a present day price. However, if these branches concentrate on digitally linking the whole value chain from end to end, they could pay off more than not just diminishing future losses but fostering productivity and strengthening whole industry ecosystems now.

[1] Losses quantified in net present worth. If losses aren’t discounted, they’d range considerably higher, wiping out most a calendar year’s gains.

Susan Lund is currently a partner of McKinsey & Company and also a pioneer of the McKinsey Global Institute.

Much more view out of Fortune:

- Why company should not need a broken government beneath Biden

- In protection of pollsters

- Should we do not vaccinate the entire world immediately, our COVID efforts are going to be a waste

- Goal, or even “goal – washing”? A crossroads for company leaders

- Dark girls are missing from business direction.