A bit over one year ago, Jennifer Mulder has been having difficulty getting her customers to execute a laborious but crucial task: monitoring their own paying.

The founding fiscal planner of Pathway Financial Services at Los Angeles,” Mulder could not appear to discover a tool which created the budgeting process easy and effortless. Quicken’s program provided a broader and comprehensive research into private finances than most of her customers were curious about, and also Mint overly frequently confused classes of paying –a customer’s Starbucks buy could appear as a car expense. Private spreadsheets that needed costs to be inputted manually, Mulder discovered, were typically neglected and left about by customers following a couple of weeks’ time.

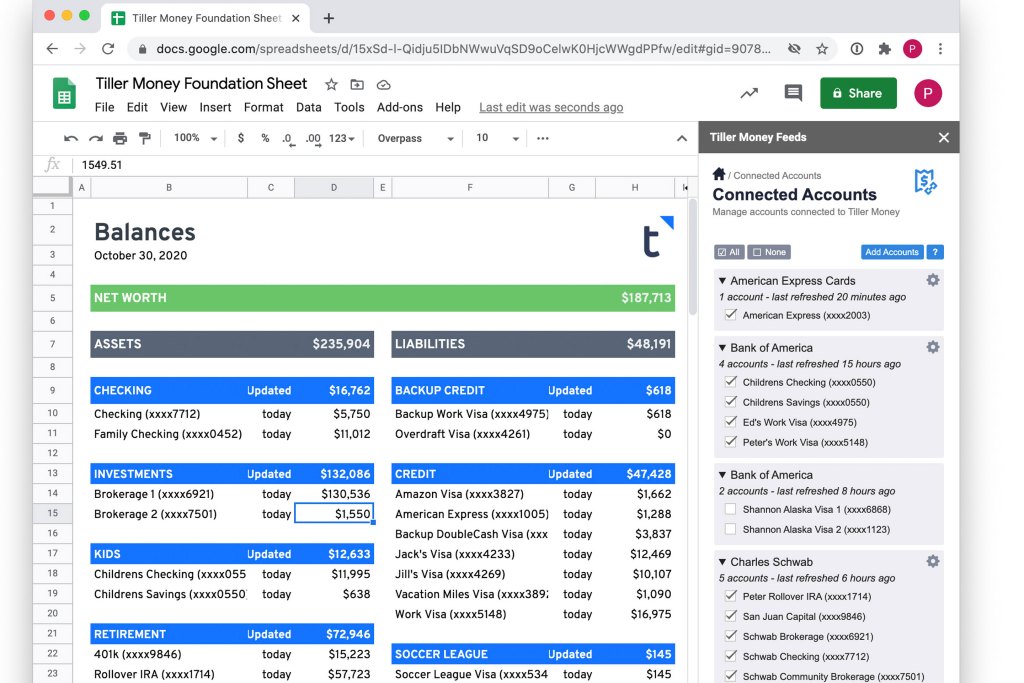

She turned into a startup which was equally creating any buzz on Twitter as well as advocated by additional financial partners: Tiller Money. An automated means of monitoring of a person’s finances on the recognizable platforms of Google Sheets or Microsoft Excel, Tiller Money has been the specific instrument Muller was searching for, enabling users to personalize their own spending classes and funding targets without needing to have the annoyance of direct data entry.

“It didn’t feel as though something which has been different from that which they were {} with, which ’s very significant when you’re hoping to get individuals to do anything fresh —-each obstacle that you put in their manner makes it {} more probable they’re not likely to really take action.”

Launched in 2015 from Peter Polson,” Tiller Money was initially supposed to be a program, but if interviewing prospective clients before the launching, Polson arrived to the identical decision as Mulder: there is comfort in {} . People Polson interviewed did not appear interested in an program; they enjoyed their clocks and were not able to change even though it meant they needed to manage date entry by themselves.

Polson knew where these folks were arriving from—-afterwards, he’d used himself during the majority of his lifetime. He left the concept of an program and rather embraced the concept of optimizing the recorder.

“Imagine if we can really take clocks into a whole other level,” Polson recalled thinking. “Imagine if we can automate them with fiscal feeds from some of your bank account and ensure it is less difficult to use Documents to offer you useful templates”

In 2020less than 50 percent of Americans state they now have a budget and also carefully monitor their spending on costs such as meals, housing, and entertainment, as stated by the National Foundation for Credit Counseling’s yearly financial literacy poll. This behavior stems in stark comparison to a lot of individuals ’s {} needs: 79 percent of Americans think “adhering to a budget rather than deviating” is vital to fiscal stability, a Northwestern Mutual research found.

Together with the Federal Reserve coverage in 2019 that almost a third of U.S. adults would have to sell or borrow some thing if confronted with an unanticipated $400 cost, the market still in a fairly precarious place, also no stimulation bill about the horizon, closely monitoring what you’re spending could well mean that the difference between having the ability to cover a bill in triggering and time into monetary chaos.

Tiller Money supplies clients with pre-built menu templates which, as with other private finance instruments, mechanically connect for as many bank account and credit cards because a client needs and categorizes trades, leaving consumers with the understanding of whether {} paying a lot time, say, eating or retail purchasing.

There’therefore a base template that provides novices with customizable yearly and monthly budgets, in Addition to more innovative templates (also customizable) for monitoring online values, savings targets, debt, and much more.

Polson stated Tiller Money’s foundation of active clients has been doubling each year, together with the business now having”thousands of thousands” of readers. Tilley Money is composed of a group of 15, for example 10 full-time workers and five builders, and has just {} financing from “a personal group of seasoned tech investors, chiefly situated in the Seattle area,” based on Polson.

And if Tiller Money will initially replicate your Google Sheet without paying classes, it is possible to alter and delete them as you see fit, enabling clients to pick and choose {that {}|that} costs should drop beneath that bucket. “We allow people construct their own principles,” Polson said. “I could make a rule which states whether it’s {} station and it’s under $15it’s likely M&M’s and kombucha, therefore it’s ingestion outside. And, whether it’s $15, it’s {} my tankso that it ’s gasoline”

Perhaps the main differentiation Polson creates between Tiller Money and competitions like Mint entails the 2 firms’ business models. Whereas Mint is a free application program, Tiller Money costs a uniform, annual subscription fee of $79. While this barely may look to be competitive edge, Polson insists that’s ideal case of the way Tiller Money values clients’ privacy over others from the business.