Our assignment that will assist you browse the new ordinary is fueled by readers. To enjoy unlimited access to the journalism, subscribe now .

Those anticipating the results of the vote tally from the rest of the swing states could be biting their nails this past week, but traders are still nothing but sweet .

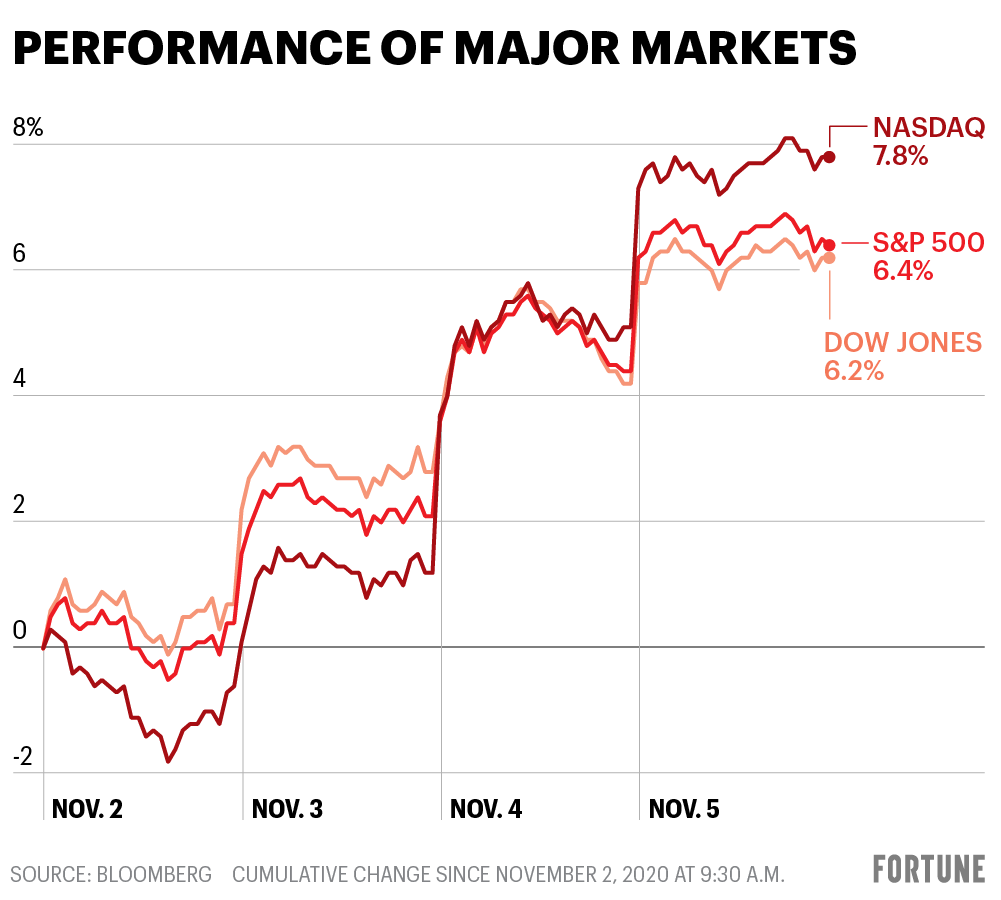

Stocks jumped again Thursday, capping a week which has seen earnings as Monday of 6.2percent from the Dow, 6.4percent at the S&P 500, and 6.8percent from the Nasdaq. Thursday alone watched the Dow near 1.8% greater at 28,390, the S&P near 1.9% greater at 3,510, along with the Nasdaq increase 2.6percent to close 11,891. Four times inthis marks the ideal week for the markets because the very first week in April, a four-day spring trading week which saw that the S&P 500 profit 12.7percent since it bounced from pandemic-induced lows.

Last week’s powerful showing sets the S&P 500 only 2 percent shy of its own all-time large, a remarkable accomplishment given the presidential race hasn’t yet been known, the U.S. retains marking gloomy new COVID landmarks , and lots of areas in Europe possess reimposed lockdowns.

Why the euphoria? Most on Wall Street have mentioned that a “relief rally” awarded the rising odds we might find a Democrat in the White House along with also a Republican-controlled Senate. ” There’s some historical foundation for this: Stocks do often do best under a split Congress. Since 1950, in accordance with LPL, they’ve increased profits of 17.2% below a split scenario, 13.4percent below a Republican Congress, and 10.7percent beneath a Democratic-controlled Congress.

There continue to be five star Senate races, and when the Democrats somehow were able to acquire three of these along with Joe Biden prevails, a Vice President Kamala Harris would function as 50-50 tiebreaker.

However, the dimmed possibility of greater corporate taxation or heavy regulation which may have been anticipated under a “grim tide ” situation has resulted in certain exuberance among technician investors.

There’s, nevertheless, still substantially hand-wringing about just what the election results might imply for another stimulus package. The Senate goes {} session next Monday. Hopefully the partisan fires that prevented us from performing the following rescue package will intrude with all the election. And I believe we will need to take action and that I think we will need to take action until the close of the year” McConnell added that help for local and state authorities might be around the desk. That would indicate a huge change as that has been among the crucial points of debate through months of discussions between House Speaker Nancy Pelosi and White House Republicans.

Meanwhile, traders cheered four days of profits and pulled out hopes that Friday could finish the week on a top note. From the words of CFRA’s Sam Stovall,”Wall Street’s favorable reaction to the yet-to-be-decided election suggests that investors believe gridlock is great.”

Much more must-read fund policy out of Fortune:

- COVID-19 resurgence lays back Europe’s financial recovery expects

- The U.S. market is gradually starting to climb from its deep gap

- Stocks perform much better beneath a split Congress

- Theft of 2.3M out of GOP reveals how efforts are hot targets for hackers

- A journalist-turned-detective on the way corporate America is determined by personal sleuths