Investors might not know yet what the political arena will look like after all of the votes are counted. But something that they could understand? How stocks {} under a split Congress, where a single party controls the Senate along with another controls the home.

But on Wednesday, stocks jumped in the chance of a separation Congress–apparently looking past the tumultuous presidential competition.

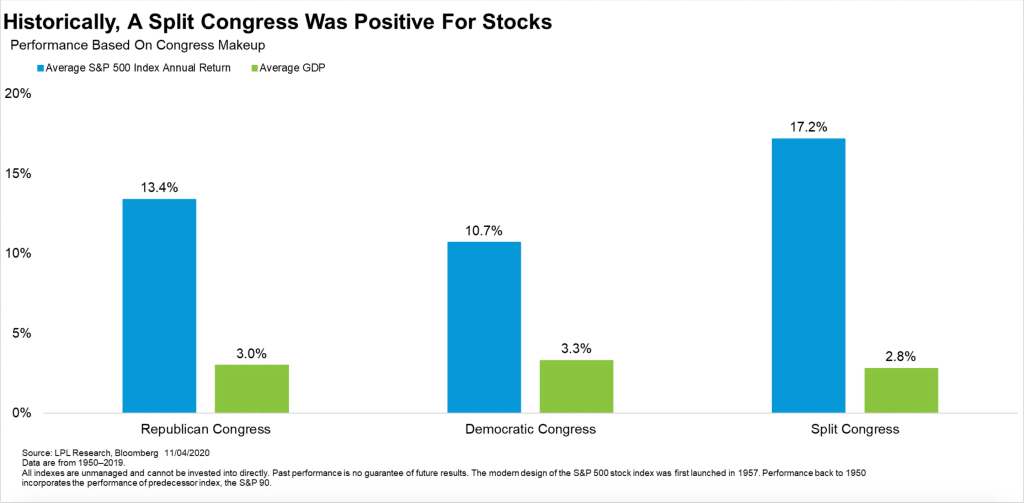

Historically, a broken Congress will be great for shares: “The S&P 500 currently has performed nicely under a split Congress, more than 17 percent on average,” analysts in LPL Financial composed in a notice Wednesday (see graph ). “In addition, in a long time with a split Congress, stocks are greater the previous ten days, with 2020 possibly function as 11th in a row. ”

The main reason is because in part to how stocks “have a tendency to enjoy gridlock and carrying out significant policy disturbance,” LPL’s Jeff Buchbinder advised Fortune Wednesday. At a 2020 circumstance, a broken Congress could diminish the probability of a huge tax increase if past Vice President Joe Biden has been elected.

Buchbinder considers short term there could be some volatility before shareholders get clarity regarding the election outcomes, however “with split government, the marketplace ought to have a less difficult time getting familiar with whatever coverage roadmap people ’re planning to buy, while it’s Trump or even Biden from the White House. ”

The U.S. has regularly had a split government previously, and “it’s had the effect of restricting a few of these more extreme suggestions for change over that time,” analysts in Columbia Threadneedle composed in a note Wednesday. “For many, this test on electricity is the more powerful result, however given the demand for further financial measures to deal with the financial harm brought on by the continuing pandemic, the capability to operate together in the forthcoming months is vital. ”

That stress above a split Congress’s capacity to operate together over stimulation (and pass on a meaningful bundle ) stays a headwind for analysts say, however so far Wednesday, “Wall Street’s positive reaction to the yet-to-be-decided election suggests that investors believe gridlock is great,” CFRA’s Sam Stovall composed Wednesday.

Much more must-read Fund policy out of Fortune:

- Uber along with Lyft stocks soar following a California labor-protections vote moves his method

- The U.S. market is gradually starting to climb from its heavy gap

- Commentary: Whoever wins the election will probably confront among the most difficult market surroundings to begin a presidential expression in background

- Theft of 2.3M out of GOP reveals how efforts are hot targets for hackers

- A journalist-turned-detective on the way corporate America is determined by personal sleuths