Our assignment that will assist you browse the new standard is fueled by readers. To enjoy unlimited access to our own journalism, subscribe now .

Buckle investors up: it may be a tough couple of days.

The S&P 500 “could quickly dive into correction land on Monday, it would not be surprising if this occurred,” states Randy Frederick, Charles Schwab’s vice president of derivatives and trading. The S&P 500 would have to touch 3,222 things to enroll a 10 percent correction from the prior high on Sept. 2.

To be certain, it’s turned into a rugged week at the markets going to Election Day on Nov. 3: Together with the Dow down 6.5percent to the week (and S&P 500 down 5.6percent ), markets only reserved their worst one-week fall as the throes of this pandemic straight back in March.

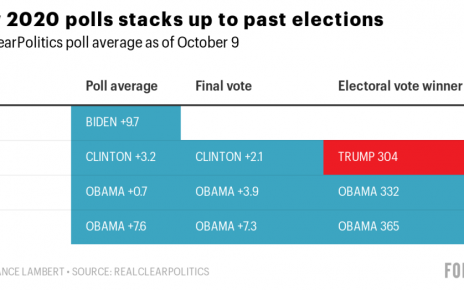

Up until recent months, markets’d felt {} there wouldn’t be a contested election, Schwab’so Frederick indicates, but it seems like some investors think the race will be tighter. With conflicting perspectives from the niches, Frederick says that he ’s viewing a mixed bag of signs, and also there might be moves down or up.

“The signs I follow are {} the map, so I can not recall the last time there was such enormous debate,” he informs Fortune. “I have some signs showing me quite powerful bullish signals, I have some revealing me quite strong bearish signals, and a few who are revealing things they generally {} show unless there is high volatility anticipated. When you receive a combination like this, about all you can say is we understand there is likely to be motion, we simply don’t understand which path. ”

The 1 thing traders can rely in the upcoming few days? “Things aren’t likely to be more calm and idle and silent,” indicates Frederick.

Strategists such as Frederick are seeing options and also the VIX, or anxiety estimate, noting the open curiosity put/call ratio to the VIX has been during its maximum level since March on Friday. But he notes indicator choices (which normally reveal more institutional action ) could be indicating some hedging for your drawback happening.

To be certain, with all the election that a mere two trading days off, traders are antsy, and also a few market observers are working to read the tea leaves: Only twice have niches drop more than 3 percent a day in seven days of election (since the S&P 500 and Dow equally failed on Thursday), and sometimes that the incumbent lost, LPL’s Ryan Detrick pointed out Thursday.

Markets overall are becoming increasingly anxious at the previous week or 2 as talks of a stimulation deal prior to the election ends , and much more about still, instances of the coronavirus from the U.S. and internationally continue to climb, igniting fears of additional constraints (several nations have already started a second around of lockdowns).

Really, sprinkled last-minute jitters within the election, that the uptick from the virus instances this week was “the largest catalyst for its disadvantage moves,” states Frederick.

However, strategists such as LPL’so Jeff Buchbinder assert we’ll watch a rally following election after a very clear winner is termed –”Whether it is Biden or even Trump, we believe that emotion can benefit,” he informs Fortune.

Much more must-read fund policy out of Fortune:

- Chobani and PayPal are paying employees more–and rethinking capitalism

- once it comes to climate change,” states Mark Carney, this fiscal crisis differs –and {}

- Ray Dalio about why Chinese citizenship is rising –and exactly why American payoff is in dire need of a repair

- Microsoft’s cloud might be somewhat foggy for another quarter

- Coinbase starts crypto debit card at U.S. using 1 percent Bitcoin reward