Make way for a different challenger.

The money injection, directed by Upfront Ventures and investment company Wafra, follows an initial $7 million debt funding around, setting the business’s total increase at $47 million thus far.

Most present fintech challengers spent decades getting customers with slick programs and no-hidden-fee guarantees, just after stressing about devoting mounting costs of customer acquisition, but partially by attracting deposit-taking in-house. Funding Club, an {} fintech leader, purchased Radius Bank for about $185 million in February. Startup Varo obtained a federal banking journey this past season. Square and, even more lately, SoFi got blessings to turn into banks too.

Jiko took the opposite strategy. Launched four decades back from Stephane Lintner, a former Goldman Sachs dealer, Jiko set out to obtain an current lender before debuting a item.

“A fintech purchasing a bank is not normal, and we spent all the past couple of years of our attempt {} –the entire round was created about it” Lintner informed Fortune. “We had very individual investors”

The plan places Jiko before a few rivals in race to meet financial regulators however much behind in enticing clients. Meanwhile, Chime, yet another U.S. challenger lender, has been climbing in popularity, leading to the eye-popping private evaluation of $14.5 billion. Additional challengers Vary from Monzo into MoneyLion.

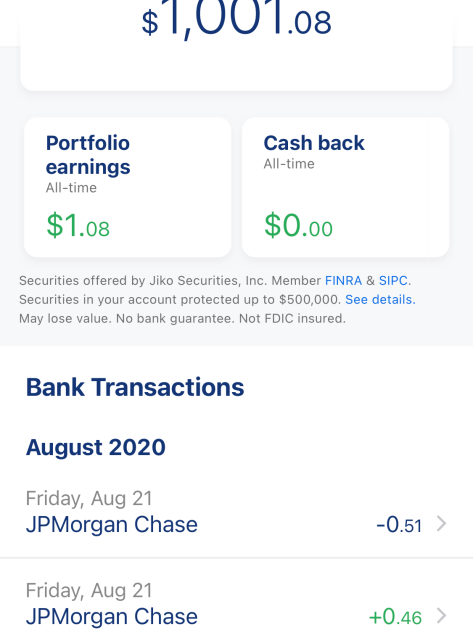

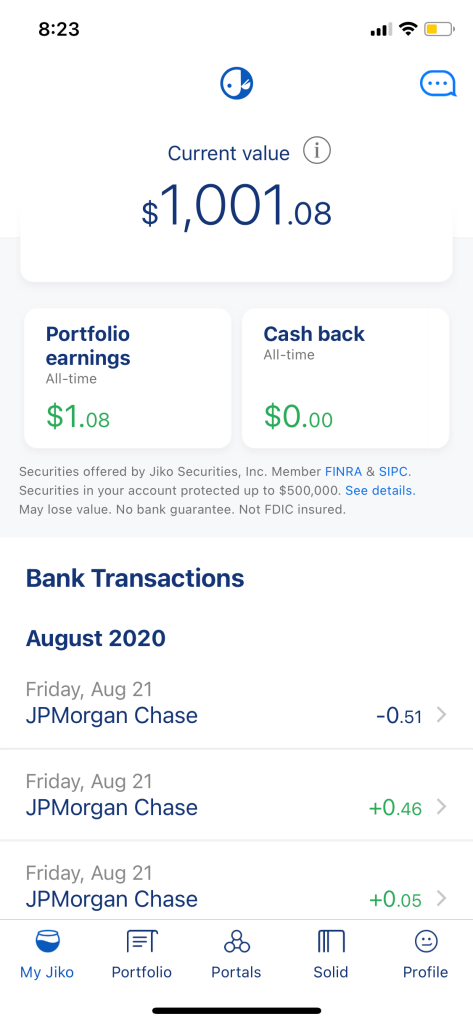

Jiko’s peculiar, slow-and-steady strategy isn’t its sole point of distinction. The company prides itself on placing deposits toward purchasing short-term U.S. treasury bills. The worth of a Jiko account is not the prospect of high returns –a dwindling fintech battleground offset the Fed’s raising of interest rates–although also the reassurance in understanding one’s capital are procured with debt.

“The return was not the center selling point,” Lintner states. “There’ll be return once there’so return, and when there’s ’s not too much there’s really not too much. Nothing else gets much return at this time, if you don’t enter really risky things, which you almost certainly shouldn’t be, correct?”

Along with now very low returns, there’another barrier to client acquisition. Jiko intends to charge people $9 per month, or even $100 annually, to keep an account. By means of incentive, the Jiko is supplying individuals 1 percent in cash-back benefits via a related debit card issued by Discover.

“It’s ’s up for us to warrant that and provide you the very best experience along with a fantastic item. We overlook ’t play matches. We overlook ’t market your information. We overlook ’t control fees, and the return is all yours”

Too large to fail

Case in point: Quibia shortform video program that billed a similarly costly cost, folded at an spectacular flameout this past month.

Colin Crook, a public relations specialist who symbolizes Jiko and is just one of its merchandise’s 1,500 or so first testers, states that a revised subscription fee is better than slipping in costs in the future. Peers offering a free version in the beginning are creating”a error,” he states, since they will probably have to add charges afterwards, as has occurred, to a level, in Monzo, Britain’s Starling, along with Germany’s N26.

Jiko’s revolve around government debt comes in a period of strain to central banks.

For Lintner, maintaining deposits backed by the entire faith and credit of the U.S. government implies, for Jiko, failure isn’t an alternative. “We’re not likely to fail as the cash is at T-bills,” he states.

{

Much more must-read fund policy out of Fortune:

- Chobani and PayPal are paying employees more–and rethinking capitalism

- once it comes to climate change,” states Mark Carney, this fiscal crisis differs –and possibly {}

- Ray Dalio about why Chinese Legislation is rising –and American payoff is in dire need of a repair

- Microsoft’s cloud may be a little foggy for another quarter

- Coinbase starts crypto debit card at U.S. using 1 percent Bitcoin reward