Our assignment that will assist you browse the new ordinary is fueled by readers.

Discuss about backward.

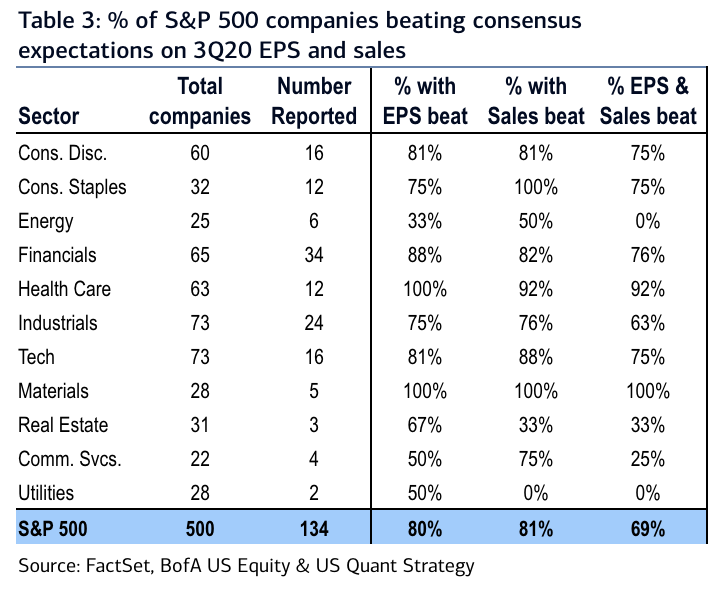

Firms crushing 3Q earnings mostly harbor ’t been rewarded with shareholders, while those lacking the mark have noticed a stock soda, in contrast to this S&P 500.

“So far this past year, businesses which conquer both the top and bottom line have underperformed that the S&P 500 from 5bps the afternoon later (worst in background ), also overlooks outperformed by 60bps, greatest ever,” strategists directed by Savita Subramanian in Bank of America composed in a note Monday.

This blueprint, as strange as it might seem, has occurred before: Stocks responded similarly throughout the Tech Bubble at 2000, “the sole earnings season ever when surprises found perverse instead of instinctive reactions–beats weren’t rewarded and misses weren’t penalized,” Subramanian notes.

It’s definitely not the first time that the present market was in comparison with Tech Bubble this season . But thus far, the part of organizations defeating earnings on the very top and base to Q3 this season is that your “most powerful post-Week 2 percentage of defeats within our information background ” because 2011, Subramanian points outside (see graph ).

Third quarter EPS is currently “currently pointing to $34.90 (-17percent y/y)up 6 percent since the beginning of October,” based on BofA, and earnings expectations for its fourth quarter will be “increasing in almost every industry, suggesting the solid earnings momentum has thighs,” UBS’s thoughts of stocks Americas David Lefkowitz and connect equity strategist Americas Matthew Tormey composed in a note Friday.

Therefore, why the odd reaction? We believe the marketplace is worried about the election, and chances for further financial stimulus, and increasing COVID-19 ailments,” that the strategists wrote.

BofA’s Subramanian is the identical head, imagining “the deficiency of alpha signals a whole good deal of very good news (or bad information ) is full of today, and Americans tend to be focused on the approaching election and macro variables … than that which occurred in 3Q. ”

Unease on the results of the election (and, possibly more importantly, across the prospect of a contested election dragging on following Election Day) could keep on producing investors touchy, though a close standstill on Capitol Hill within a new form of stimulation has shipped the markets reduced.

”

But better times might lie ahead: UBS quotes that the S&P 500 will strike 3,700 at June a year ago –which could be greater than 9 percent greater than Monday’s amounts.

This business says