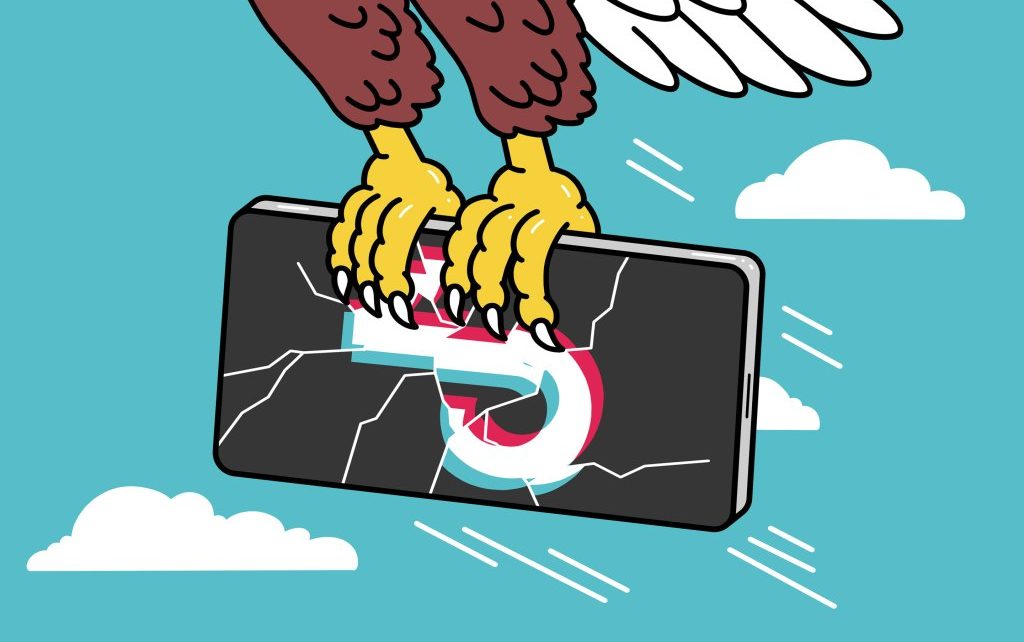

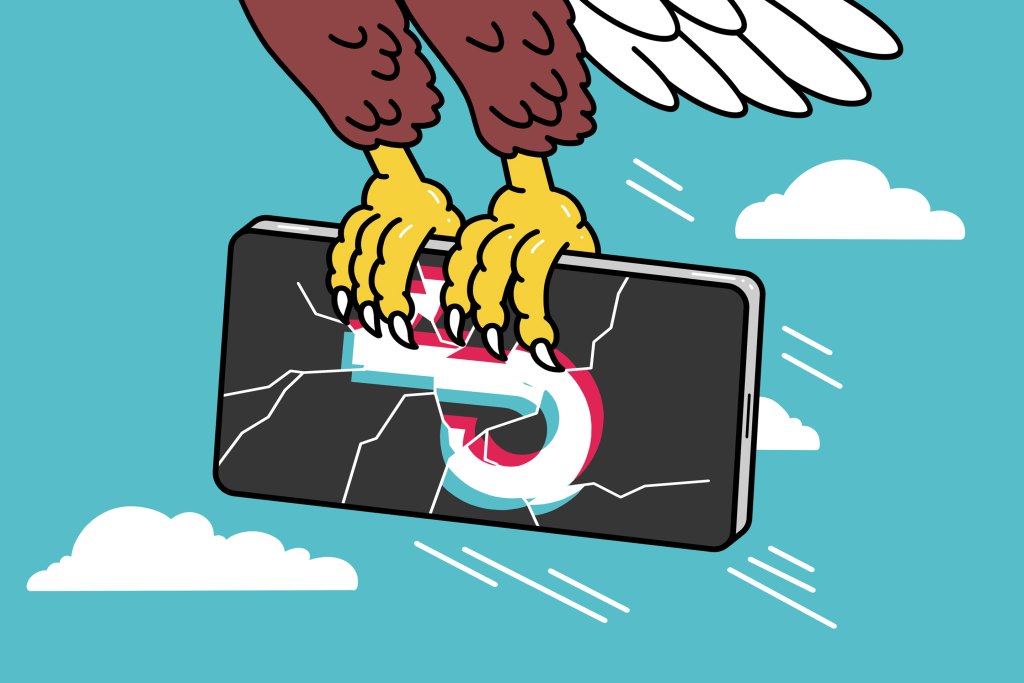

This summertime, as soon as the Trump government ordered the favorite social networking program TikTok to market its U.S. surgeries , it indicated a new escalation in the U.S.-China commerce warfare . The conflict also introduced much of the public, such as lip-synching teens and their parents, into some close body named CFIUS–that the Committee on Foreign Investment in the United States–that may loosen or block overseas acquisitions of U.S. resources from the name of domestic security.

CFIUS (pronounced”SIFF-ee-us”) may have closing sign-off on a planned deal to supply partial control over TikTok into your coalition of U.S. shareholders and businesses, such as Oracle along with Walmart. After an obscure corner in Washington’s regulatory labyrinth, CFIUS has since increased radically in {} in the last few decades, since Congress frees up its own mandate as a portion of a technological arms race with China and other competitions. Its widening ambit will redefine the connection between foreign firms and the U.S. government. However, the TikTok saga, which might observe a notable supporter of President Trump get a large stake in the program, can also be stoking that a backlash among critics that view CFIUS as a highly effective instrument for crony capitalism.

CFIUS was launched in 1975 by President Gerald Ford to protect strategic sectors like petroleum and munitions from control. For decades it had been seldom staged: Brian Fleming, a former national security attorney for the Justice Department who’s currently a lawyer at Miller & Chevalier, quotes that the Obama along with Trump administrations obstructed fewer than 1 deal per year between 2009 and 2017.

The rate accelerated, however, since the Trump government embraced a bellicose position on China–as well since lawmakers across the political spectrum climbed more concerned about patents, data, and technology experience passing from U.S. control. At 2018, CFIUS ceased China’s Ant Financial from purchasing money-transfer agency MoneyGram and scuttled an attempt by Singapore-based Broadcom to obtain processor giant Qualcomm. That legislation not only enlarged CFIUS’s enforcement forces but also gave it a fresh mandate to safeguard U.S. consumer information –such as which gathered by TikTok along with its Chinese parent firm, ByteDance.

The arrival of FIRRMA has triggered a stampede of CFIUS activities. The inspection procedure is extremely secretive, but as stated by the Washington Post, the board has established dozens of investigations that this year, aimed mostly at firms who received investment in China or even Russia. A few probes retroactively test deals finished years back: The TikTok analysis, as an instance, rose from ByteDance’s 2017 buy of a Los Angeles–based firm named Musical.ly.

CFIUS consists of the chiefs of eight government agencies, led by the secretary of the Treasury. It may intervene in any arrangement between foreign investors where there are national security issues –a rationale which may extend to almost any trade, attorneys thing. While social networking platforms such as TikTok and Tencent’s WeChat are the most notable recent goals, other businesses are from the panel crosshairs. Nevena Simidjiyska, cochair of their worldwide trade team in Fox Rothschild LLP, that has recently seen an uptick at CFIUS function, claims that the mobile game sector –that has lots of ties to China–is most probably the following to face evaluation.

For years, CFIUS was seldom invoked. However a 2018 legislation has triggered a stampede of new analyses.

Simidjiyska and many others assert that CFIUS inspection is extremely vulnerable to political influence. Members of Congress who want to flaunt civic credentials may lean CFIUS to obstruct a bargain or loosen it retroactively. And U.S. firms also have urged lawmakers to need CFIUS investigations in their corporate contests.

In this new climate, most attorneys say, employers are taking measures to prevent CFIUS evaluation. Some may structure deals in this manner that overseas investors have a passive function, without a board chairs or executive attendance; others may just decrease Chinese investment entirely. And in certain instances, businesses gently pull the plug on a planned bargain upon understanding that CFIUS plans to earn a negative recommendation to the President. While companies can turn into the courts should they see CFIUS’s activities as random or heavy-handed, this might be a very long shot. Just 1 firm has gone into court within a CFIUS sequence, and the case settled with no judgment about the underlying problems. And U.S. judges generally Provide the executive branch wide deference on issues of domestic security.

This deference, together with CFIUS’s rising extent, has amplified concerns which the procedure may be used for nakedly political ends. Most China hawks shared President Trump’s mentioned concerns regarding the impact of TikTok along with WeChat. However, his open advocacy of a possession bidding by Oracle–whose cochairman, Larry Ellison, sponsored a top-dollar design for the President earlier this season –has raised hackles in Congress and also C-suites alike.

“Perhaps you have broken the fourth wall in regards to CFIUS, also entered a bold new world in which the President can intervene and meddle in a sense nobody pictured?” It was seen if the TikTok event is a one off, and if the enmeshing of geopolitics and company will continue under a different President, of either party.

Since its formation in 1975, CFIUS has gradually evolved by a regulatory footnote into some trade-war weapon. Some Important dates in the pre-TikTok age:

Concerned over Japan’s technology art, Congress provides CFIUS the ability to reject overseas investments.

1990: This deal will not fly

The government of George H.W. Bush utilizes CFIUS to purchase a Chinese company to divest MAMCO Manufacturing, a Seattle-based aircraft-parts manufacturer.

The Dubai Ports World consortium strikes a bargain to attain management of six U.S. seaports. CFIUS approves the program, however, Congress votes to block it.

President Obama requests Chinese-owned Ralls Corp. to divest wind turbines it obtained near a Navy website in Oregon.

2018: The artwork of no price

President Trump invokes CFIUS to pub Singapore-based Broadcom from taking out a $117 billion hostile takeover of both all chipmaker Qualcomm.

A variation of the report appears from the November 2020 problem of all Fortune using the headline,” “A highly effective tool for transaction hawks. ”

More tales from Fortune‘s print variant :

- “the entire world is coming together”: The race to get a COVID vaccine is Presenting Large Pharma

- The activist worker has never gone

- Allbirds is stepping up to the world –by treading softly onto it

- How naive traders are forcing a brand new gold rush

- Fortune’s 2020 Change the World listing