This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. U.S. futures are fairly flat, but there are plenty of green shoots.

Europe’s energy stocks and crude prices continues to gain, as does Bitcoin. In the U.S., tech futures look strong, buoyed by impressive results from PayPal, eBay and Qualcomm after the bell yesterday.

Weekly jobless claims come out in a few hours, and tomorrow we have the first non-farm payrolls report of the Biden presidency. Speaking of the president, Biden won’t budge on his promise to deliver a new batch of $1,400 stimulus checks, but he’s open to making the give-away more targeted.

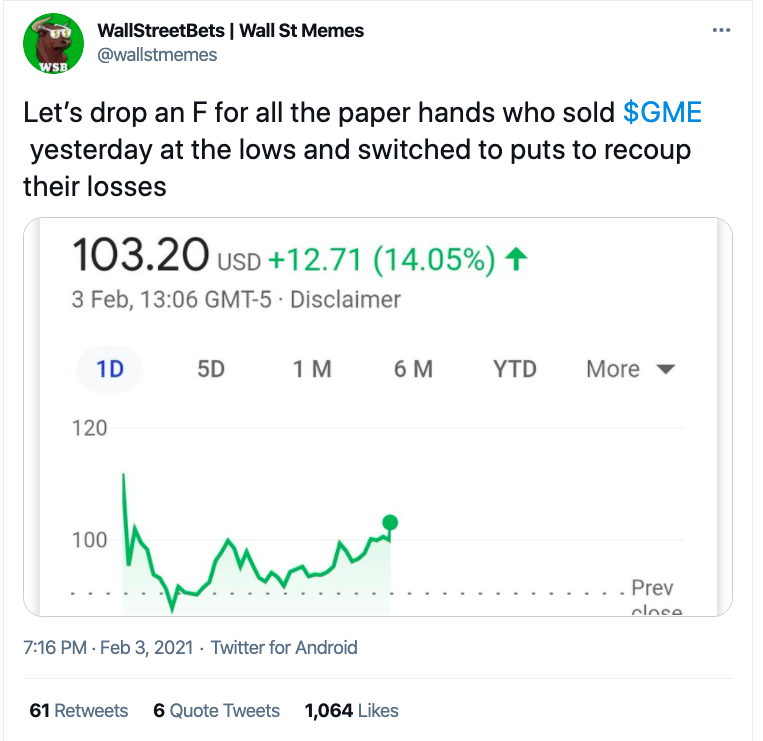

The Reddit brigade, for one, is getting restless for Round 3 of stimmies. As Wienerdawgy shared on WallStreetBets, “I used my $600 stimulus on AMC last week, flipped it for some profit and bought GME, BB and more AMC lol.”

Wienerdawgy is what we’d call impavid. A real bull.

Let’s spin the globe and see if we can find any more Wienerdawgys out there.

Markets update

Asia

- The major Asia indexes are mostly lower in afternoon trading, with Japan’s Nikkei down 1%.

- It will be the biggest IPO since Uber in 2019—Chinese short-video app Kuaishou is slated to go public tomorrow in Hong Kong; it’s looking to raise $5.4 billion. It’s being powered, in part, by China’s live-streaming farmers.

- There’s a bit more clarity today on a report that Hyundai-Kia will team with Apple to co-develop an electric car model. The carmaker’s shares were down on the news after huge gains on Wednesday.

Europe

- The European bourses were modestly higher out of the gates with the Stoxx Europe 600 flat at the open, before climbing.

- Shares in Deutsche Bank were up more than 3% at the open this morning, before falling, after the German lender reported its first full-year profit in six years.

- Alas, 2020 was a brutal year for energy giant Royal Dutch Shell. It reported a big drop in adjusted full-year profits, but raised its dividend nonetheless.

U.S.

- U.S. futures have been trading sideways all morning. That’s after the major indexes eked out meager gains on Wednesday.

- McKinsey has agreed to pay $550 million to settle a mountain of claims for its part in “turbocharging” America’s opioid epidemic.

- Shares in PayPal are up 4.5% in pre-market this morning after the fintech giant reported knockout Q4 numbers yesterday, helped by its new cryptocurrency and “buy now pay later” offerings.

Elsewhere

- Gold is down, trading around $1,825/ounce.

- The dollar is up. The greenback has had a good week.

- Crude is up, with Brent pushing near $59/barrel.

- As of 10 a.m. Rome time, Bitcoin was up nearly 7% at $38,500. Next stop: 40K?

***

Buzzworthy

Timing the tendies (parody)

No regrets, no surrender

The amore for central bankers = forever

The 100 million club

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

[email protected]

As always, you can write to [email protected] or reply to this email with suggestions and feedback.