It’s risk-on afternoon as stimulation talks and vaccine advancement raise investor opinion in Tokyo to New York.

In addition, we have a huge new stock exchange debut now. DoorDash starts trading in a couple of hours, along with also the bidding so much continues to be ferocious. Even the IPO share price is over 100 dollars, the Wall Street Journal accounts , citing resources in the know.

Permit ’s view where investors are placing their money.

Trader upgrade

Asia

- The most significant Asia indicators are largely higher in day trading with Japan’therefore Nikkei upward 1.2percent, continuing its remarkable run. Investors have been using a $708 billion stimulation package to rekindle Japan’s COVID-hit market.

- SoftBank was upward 5.6percent on information that the technology conglomerate/investment team is mulling a plan to quietly purchase shares and take itself personal, Bloomberg accounts , citing resources.

- This ’s great news for automakers. Automobile sales at China, the planet ’s largest market, increased in November, additional proof the two-year downturn is finished . Boris Johnson heads to Belgium in a couple of hours to get a dinner date using Ursula von der Leyen to determine whether both could sew post-Brexit trade discussions .

- Meanwhile, the Britain resumes its nationwide COVID Legislation app, a rollout which went smoothly .

- The Wirecard scandal has claimed yet another scalp since Deutsche Bank’so thoughts of bookkeeping resigned since prosecutors at Munich step up their research to the insolvent obligations firm.

U.S.

- U.S. stocks are a bit higher following the S&P 500 along with Nasdaq completed Tuesday back in record land despite little improvement about reaching a deal to a $908 billion (or bigger ) stimulation package. However, the simple fact the 2 sides are still negotiating is really a fantastic indication, the markets guess.

- Tesla stocks closed 1.3percent greater yesterday after it appeared the EV manufacturer could exploit the capital markets to get another time this season, expecting to increase near $5 billion at a share-sale.

- Apple stocks are level in pre-market trading, indicating investors aren’t dismissed with its newest $550 cans . Why so pricey? They move about your ears so that it ’s likely you’ll keep misplacing thema lá the AirPods.

- The buck ’s slip continues now. {

- Crude is upward, together with Brent futures {} $49/barrel. |} The digital money has been currently down 6.3percent , trading under $18,000.

***

An opinion in the C-suite

So when will the broader market catch until the stock exchange markets? It’therefore a matter which ’s been top-of-mind since stocks began their remarkable comeback in April, even as the international market sputtered and wheezed.

We’ve noticed GDP scale ago, however it’s been a very irregular restoration, and financial output remains well behind pre-pandemic degrees.

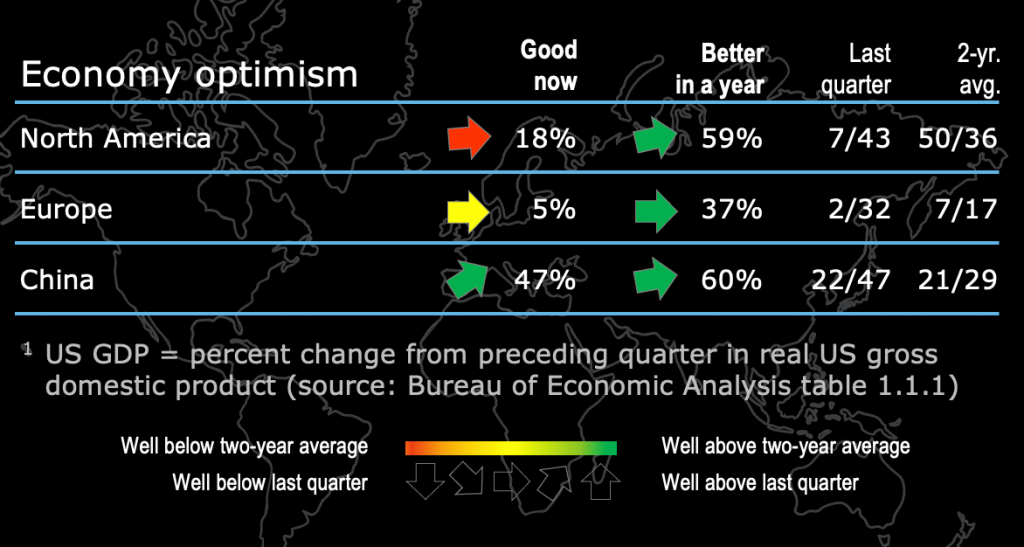

Thus it’s especially timely to have a check-up together with all the finance chiefs in the planet ’s largest businesses. Deloitte’s CFO Signs poll –that we now ’ve covered within this area before–reveals a better prognosis as we venture into 2021. Even people downers at Europe see improved days in 2021.

The bullish subset of all CFOs are discovered in China where almost half (47 percent ) say the market is “great today,” and 60% say it’ll be better a year from today. CFOs from North America have an equally rosy view, as the picture above shows. But the exact CFOs are worried about the initial half 2021 as stimulation talks are still snowball and they keep careful optimism regarding the rate of this vaccine rollout.

The poll has been first conducted in mid-November if the S&P was investing about 3,500. (It closed at 3,702 yesterday). At the mid-November level, almost 60 percent of survey respondents anticipated the grade to grow farther by the year old. However here’s what –”80% also state it’s overvalued. ”

80%!

Considering that the mid-November timing, {} Joe Biden has been called President-elect, the CFOs represented on coverage issues, also. They’ve a large wish list for Washington. “As a new government takes more than CFOs overwhelmingly support a fresh stimulus package, infrastructure investment, and de-escalating US-China commerce pressures, less protectionist commerce, along with also the national authorities leading a COVID-19 reaction,” the report reads.

“Though there are business gaps, CFOs’ expects for Washington center mostly on enhanced bipartisanship and cooperation in getting things done, and on joining the nation with much more ‘moderation,’ ‘transparency,’ along with ‘decency.’ ”

Allow ’s trust Washington is listening.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

Bernhard Warner