Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.

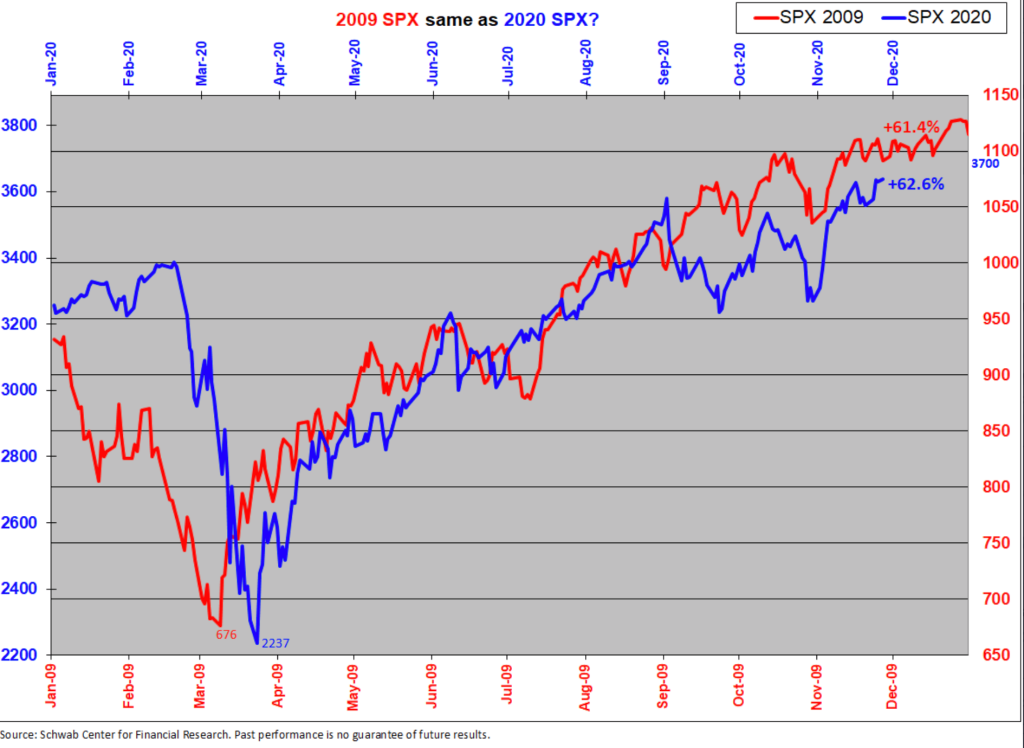

Investors who were around in 2009 might be having déjà vu this year.

That’s because the S&P 500’s run so far in 2020 has eerily tracked the market’s path in 2009, with similar dips and recoveries, strategists have pointed out. Randy Frederick, Charles Schwab’s vice president of trading and derivatives, is one such prognosticator who has long highlighted the roadmap’s accuracy this year—and even he is a little surprised.

“Amazingly, it never really deviated for more than just a few days,” Frederick tells Fortune. “I always expected it eventually to break down but it frankly just never did.”

What’s more, with that pattern having continued “a lot longer than I thought it would,” Frederick says, he believes “it’s pretty late in the game to think it’s going to deviate a whole lot” going into year’s end with about four weeks left for trading.

Indeed, with a selloff to end the month of November, that map appears to be holding up.

“This is kind of exactly what I was expecting: Once we got to that new [S&P 500] high or close to it I thought we might go into a sideways, choppy period that might last two to four weeks and it does appear we’re in that right now,” Frederick says.

Certainly what’s driving this year’s market is “entirely different” than 2009, notes Frederick, with a pandemic (not a man-made financial crisis) shifting markets from red to green all year and record-fast bear markets and recoveries.

But based on the pattern, Frederick believes the market will still end the year higher—even if it’s not a smooth ride.

A choppy December?

Despite a selloff on the month’s final day (with the S&P 500 down 0.46% and the Dow down nearly 1%), stocks finished November almost 11% higher, in line with the historical precedent that, especially during election years, November is a strong month for investors.

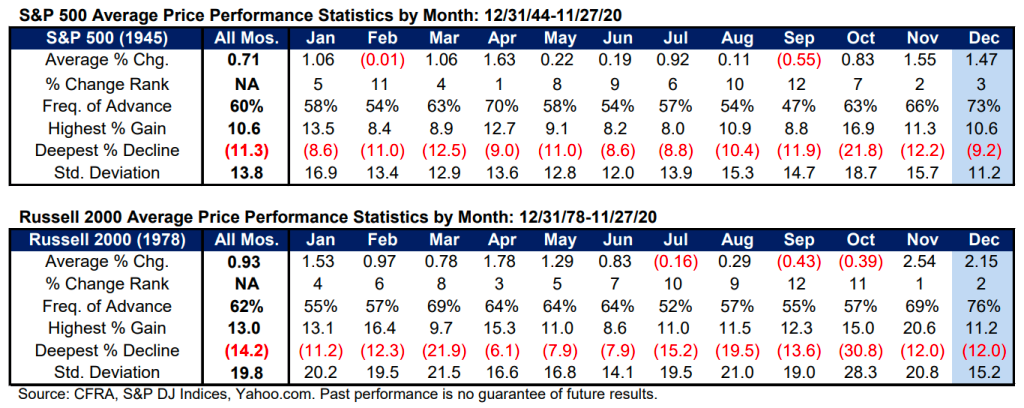

And when that happens, according to history, “December traditionally maintains this aura of optimism,” CFRA’s Sam Stovall wrote in a Monday note. However, “the recent three-way all time high by the DJIA, S&P 500, and Russell 2000, combined with the outsized gain for the S&P 500 in November,” may mean investors aren’t going to get quite as big a gift near the holidays.

Moving into December, “history warns, but does not guarantee, that December’s advance could be subdued,” CFRA’s Stovall writes. “Whenever the S&P 500 gained 5% or more in November, which happened 14 times since 1945, December’s price rise and frequency of advance were below average.” (See chart below.)

Apart from the historical gains for December, the remarkable similarity of 2020 and 2009’s market runs suggests December might be a bit bumpier for stocks, Frederick notes. If the S&P 500 stays the course, however, Frederick expects stocks to end the year around 3,700, a roughly 2% rise from Monday’s close.

Plus, there’s always the chance of a so-called Santa Claus rally to boost stocks in the final days of the year.

More must-read finance coverage from Fortune:

- $1 trillion in stimulus at stake: The shape of a deal hinges on the Georgia Senate runoffs

- Pandemic fallout is about to overwhelm the bankruptcy system—and hit small businesses hardest

- Why Tesla stock could go to $1,000, according to a Wedbush analyst

- Japan’s jailing of Carlos Ghosn was overly “harsh” and compromises their case, U.N. rights lawyers say

- Small cap stocks are having their best month ever