Happy Friday, Bull Sheeters. International stocks are high, but U.S. stocks are at the red as investors contend with a series of debilitating information: coronavirus instances are soaring, America’s Thanksgiving travel programs are not sure, the labour markets have taken a turn for the worse, and the clock ticks down to a national emergency financing program.

Permit ’s check on the task.

Trade upgrade

Asia

- The most Significant Asia indicators are combined in day trading together using all the Shanghai Composite the very finest of this Group, upward 0.4percent .

- Embattled Chinese sociable networking company Joyy Inc. bounced back Thursday, with stocks increasing 17 percent from New York trading. This ’s following the company contested short vendor Muddy Waters’ offenses it’s accountable of prevalent fraud, such as allegations that it ’s its consumer numbers.

- Not too fast with all the Remdesivir, doc. Even the WHO has warned against against with the medication to take care of hospitalized COVID sufferers on reasons that there ’s “no signs that it enhances the demand for ventilation” Shares in Remdesivir manufacturer Gilead Sciences were down 1.6percent from pre-market trading. The Europe Stoxx 600 was upward 0.3percent a half-dozen to the trading session.

- The European Union may fork over up to $10 billion to Cover a Gigantic pile of COVID vaccine dosages Produced from Pfizer-BioNTech and CureVac, Reuters reports in a big scoop. That might presume a $15.50 per dose commission ($18.34) for its Pfizer-BioNTech vaccine.

U.S.

- U.S. stocks are down using Dow stocks {} 250 at one stage. On Thursdaythe three big indicators closed higher following midnight at the last hour of the trade.

- An uncommon people rift has surfaced involving Treasury Secretary Steven Mnuchin along with also the Federal Reserve about the future of a continuing emergency financing program for company and municipalities. The program had been released at the spring when bank markets but rallied. The Fed would like to expand itMnuchin would rather observe the app expire.

- Airline shares –such as Delta Airlines United and Southwest Airlines–have been trading reduced in the pre-market on Friday following the CDC issued a medical advisory warning yesterday, stating please don’t journey for Thanksgiving this season .

Elsewhere

- Gold is upward, trading under $1,870/oz .

- The buck is level.

- Crude is upwards also with Brent trading about $44/barrel.

***

From the amounts

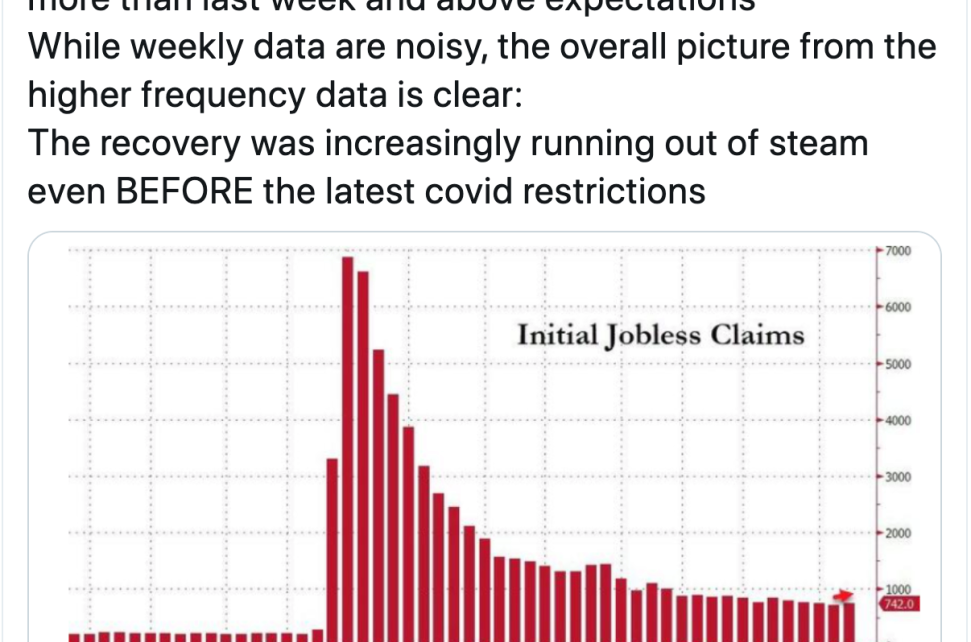

742,000

We harbor ’t spoke a great deal about the U.S. labour market in a little while. This ’s because investors have shrugged off the information. Provided that a stimulation deal was a chance they were ready to forget it. However, after ’s worse-than-expected jobless claims amounts —742,000–a variety of Wall Street vets are {} sounding the alert which America’s economic recovery is still at peril. This creates the Mnuchin-Fed debate so unnerving. Economists see a demand for incorporating stimulation to the U.S. market, not carrying it off. UBS chief economist Paul Donovan sums up that coverage conundrum in a note to investors this afternoon: “Given {} increased limitations on the US market, economists tend to side with the Fed. Markets prefer it {} shows joined up thinking–that this circumstance isn’t joined up and reveals limited signs of believing. ”

1,919.62

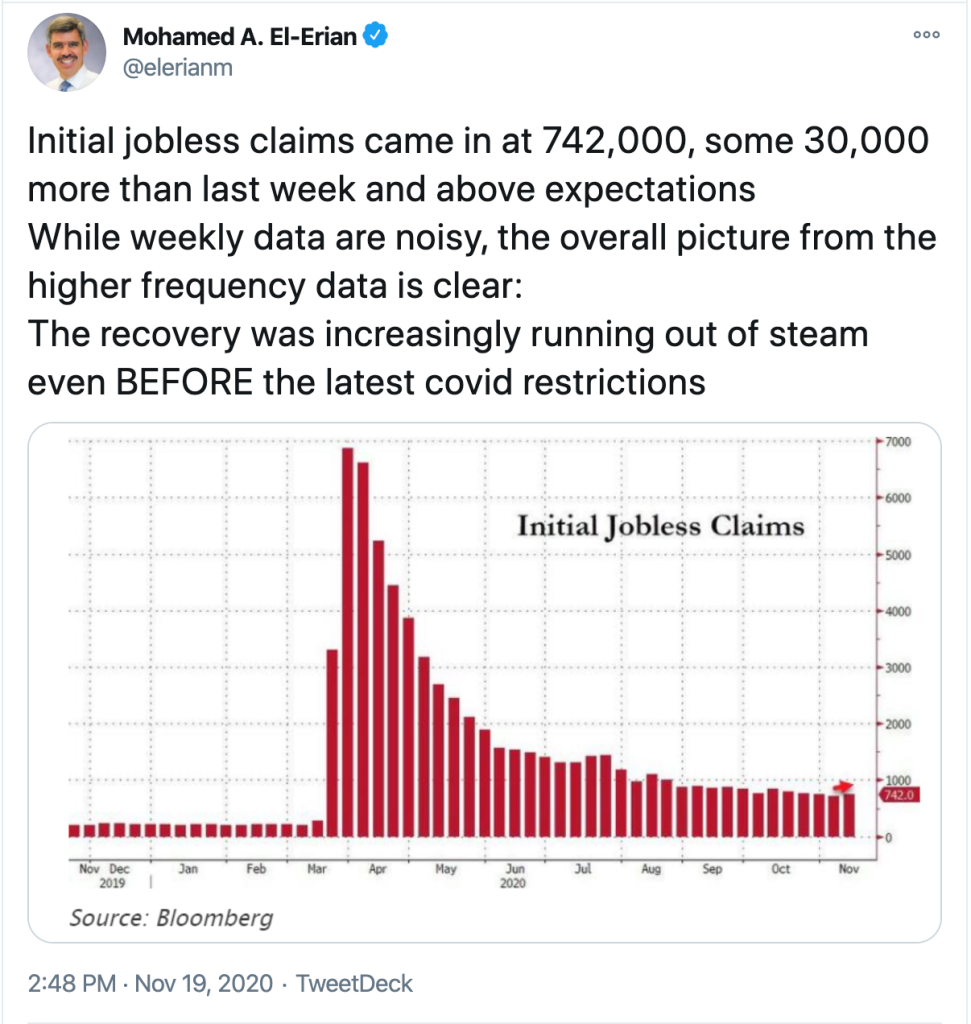

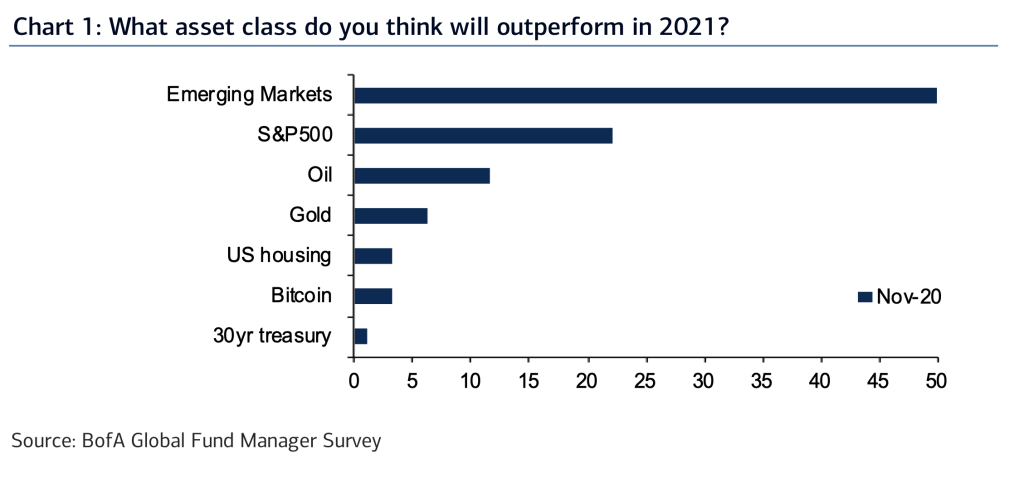

Normally within this place I examine the observation five-day operation of a few of those huge indicators. However they’re flat as a pancake weekly. Thus, allow ’s head directly for the week’s huge winner, Bitcoin. The crypto money is upward 12.7percent as Nov. 13, obtaining an amazing $1,919.62. Even the Bitcoin bulls are out in force, eyeing a 20K manage. However, you understand that who ’s not confident concerning the Bitcoin rally? Finance supervisors. Since I detailed before this week, finance managers visit Bitcoin underperforming the S&P 500, golden along with oil following year.

-3.28

S&P 500 stocks are at the red, because I type, along with the standard indicator is down 3.28 points up to now this week. The motion isn’t all that noteworthy, however, the background is. Since Joe Biden was announced the winner of this presidential elections almost two weeks past, cash has flowed to the markets in a lively pace. The current fad of inflows has happened alongside increasing optimism about a vaccine and expectations using a split government. ” The S&P is upward 3.7percent previously month, but continues to be trading quite flat over the previous two weeks. The principles are there to get a breakout. Stay tuned.

***

Postscript

With shares on the move yesterday, Bull Sheeters saw themselves in a creative disposition. An extra two viewers sent me their markets-inspired poems to discuss.

To start, from R.E., hailing out of the beautiful Channel Islands.

The economies were down because of Covid,

And stocks could be needed for a very low bid.

However, the bulls have come out because the vaccine

Thus progressively returns will wax thin.

There is a pivot from technology stocks to appreciate

Lifting airlines, resorts and Complete also

Elon Musk only sits fairly with Tesla

earning more yield than an embezzler!

I’m imagining R.E. prefers to have about into a sailboat.

And ’s only from P.N. in South Africa.

Who composed about shares to fatigue

His favorite footnotes

Were Italian anecdotes

That Could bring a fortune on auction

Thank you P.N.! … Ahem, manager. I believe R.E. is speaking about me.

Caution: it’s quite dreadful. However, it’s Friday. So here is:

Knock, knock!

Who’s ’s there?

Don’t shout. It’s just down 0.1percent YTD.

I tried out that one in my children, and they stated, opt for it, daddy! Honest.

I understand. Then the boss will mercifully put a stop to our Postscript imaginative hour.

***

Have a wonderful weekend, everybody. I’ll find you on Monday… However, {} there’s additional {} below.

As always, it is possible to write to [email protected] or answer to the email with hints and opinions.