In spite of optimistic changes on the vaccine leading , the pandemic will be far from above: On Thursday, fresh supported COVID-19 instances in america struck a daily list of over 150,000.

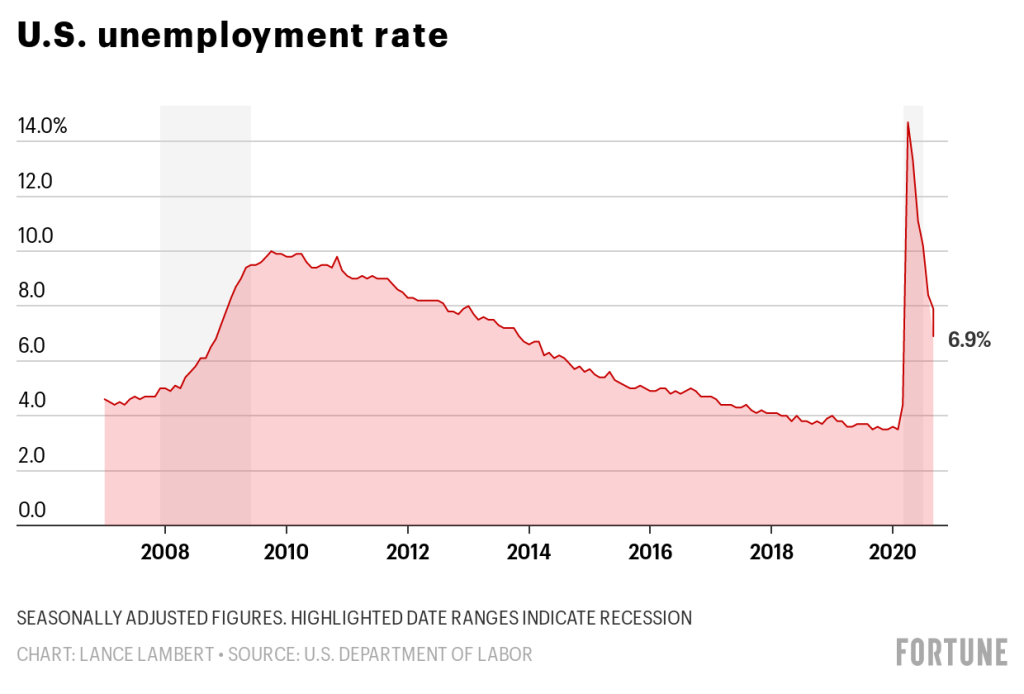

However, on the financial front, we are continuing to see advancement. As nations eased lockdown constraints from the summer and spring, the market changed from the worst regeneration ever into one of the quickest recoveries. Really, the unemployment rate which struck a summit of 14.7percent in April has since return to 6.9percent at October.

Nevertheless, we are not from the woods yet. More company failures are on how firms hardest hit by the pandemic run from money. And of course that the poor labour market makes it almost impossible for the utilized to get increases as well as the millions of jobless Americans to come across a pay check. We are in healing, however not all people are setting it.

To Provide Fortune viewers a better Comprehension of where the market is and where it is heading, Here Is a glance at eight economical dimensions we have been monitoring throughout the catastrophe:

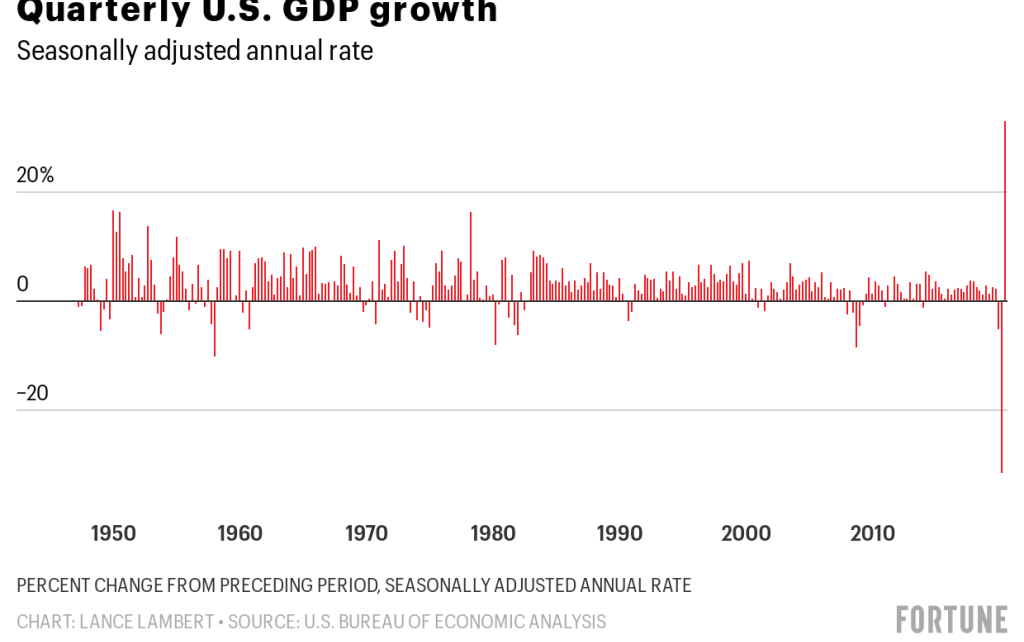

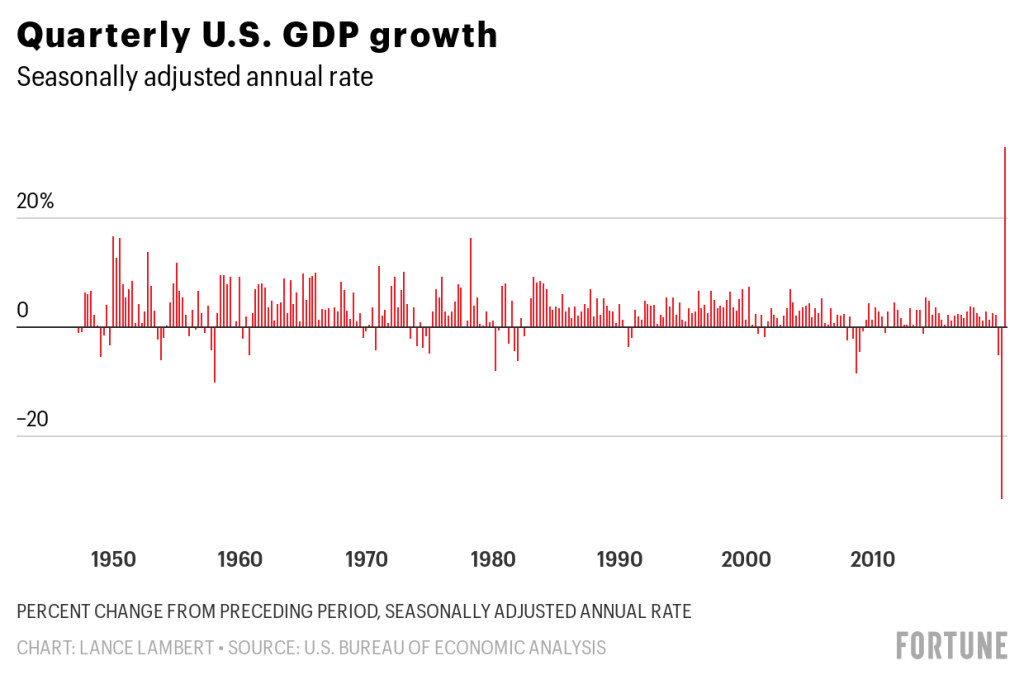

From the first quarter, GDP fell 5 percent on an annualized basis, followed closely by a listing 31.4% annualized GDP decrease in the next quarter. Throughout that interval economists across the world have been in a fear and questioning when the United States–and the remainder of the planet –had been on the cusp of an economic downturn.

After states started to facilitate lockdown limitations, that the U.S. market sprung from heavy contraction to elevated growth. In the next quarter, from July to September, GDP increased 33.1percent on an annualized basis, based on data published by the U.S. Bureau of Economic Analysis.

However, GDP is down. Over the duration of the first 2 quarters, now annualized U.S. GDP dropped from $21.8 billion to $19.5 billion. In the next quarter which swung back around roughly $21.2 billion. It is predicted to completely rally in 2021.

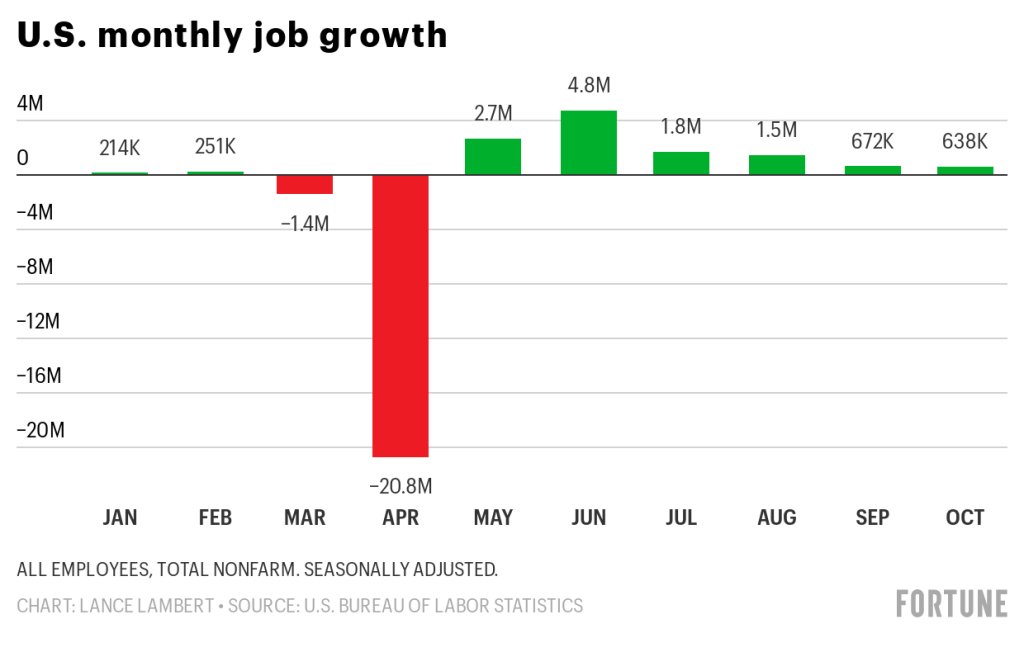

While GDP is viewing something nearer to some V-shaped recovery–rebounding back almost as quickly as it dropped –which is not true for U.S. employment. The U.S. additional 638,000 projects in October. If that rate were to continue, it could happen over 16 weeks –to 2022–to regain all of the jobs lost during the COVID-19 downturn. And that is not even the terrible thing. Most economists really anticipate that rate of hiring to impede further, meaning that a complete employment recovery can take until 2023 or more.

We have since changed to a restoration that’s moving faster than most economists expected. That defeats the deadline that the Congressional Budget Office projected in May, as it forecasted that a 9.5percent unemployment rate in the conclusion of 2021.

Throughout the wonderful Recession age, the unemployment rate peaked at 10 percent in October 2009. Plus it did not turn it back to 6.9percent before November 2013. Thus by recent historical standards, this restoration is going at a rapid pace.

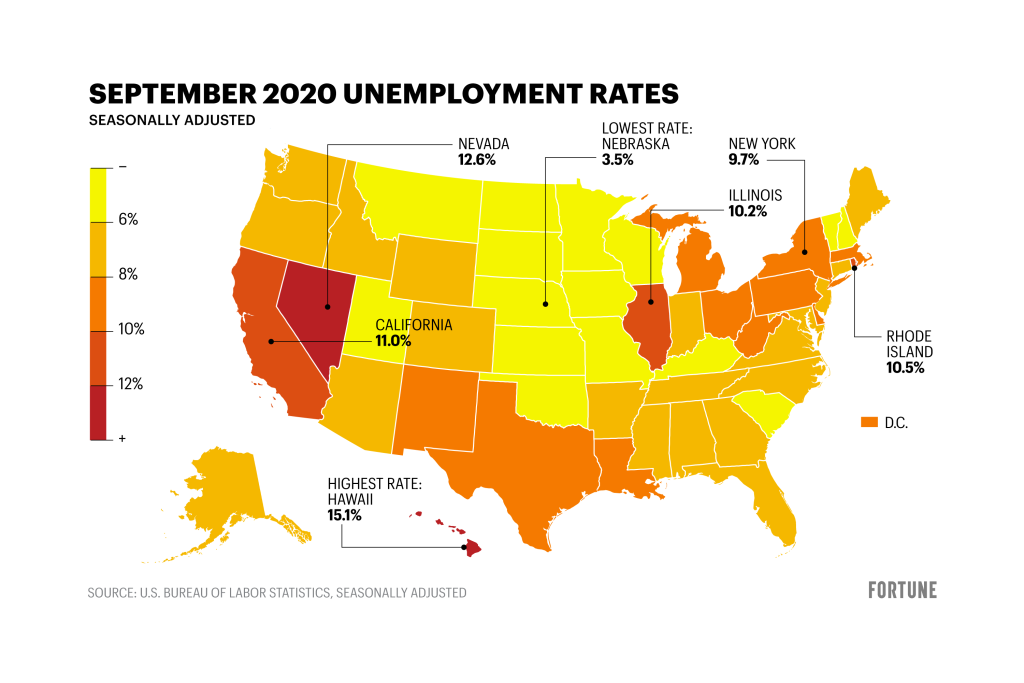

However, this financial recovery is anything. Even though the unemployment rate from September at Nebraska sits in 3.5percent, Nevada has a jobless rate of 12.6percent.

How did these markets get so broken? A great deal of it boils down to what sorts of tasks constitute each nation’s economy. While Nevada has {} to some 12.6% jobless rate, it is going to struggle to completely recover until the vegas tourism industry has returned to normal–a thing that’s not likely to occur until the pandemic is still in check.

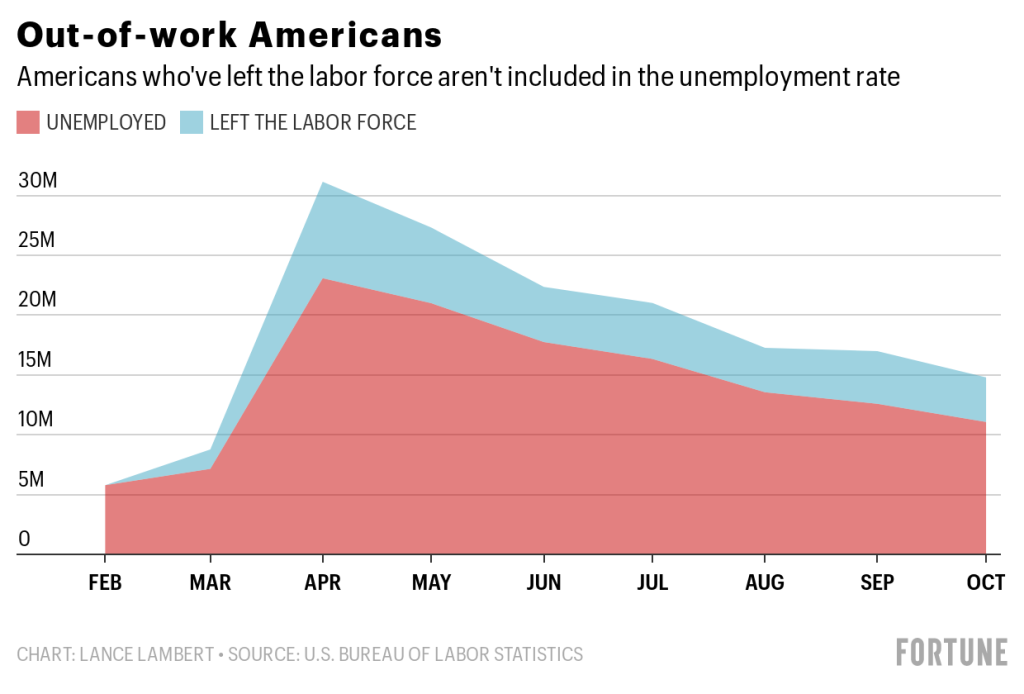

While the continuing drop in the unemployment rate indicates a market moving out of recession to expansion, it is also badly undercounting joblessness. It boils down to the way the Bureau of Labor Statistics (BLS) computes that the official unemployment rate: Just out-of-work Americans that are hunting for new places are classified as jobless. In the event the jobless are not looking, they have thrown from their civilian labour force completely. (The unemployment rate is figured by dividing the amount of jobless Americans from the civilian workforce count).

That has been true throughout the pandemic, together using tens of thousands of jobless Americans opting to wait for the virus and pre-order arrangement before beginning their job hunt to remain home with their children not having resumed in-house learning. Total the civilian labour force dropped from 164.5 million in February about 156.5 million in April. It has since climbed around 160.9 million–although it is down 3.6 million.

In case the 3.6 million unemployed Americans who have yet to go back to the workforce must be contained in the unemployment rate–that which Fortune believes the”real” unemployment rate–it’d sit 8.9percent in October, Fortune computes. That is well above the 6.9percent official unemployment rate calculated from the BLS.

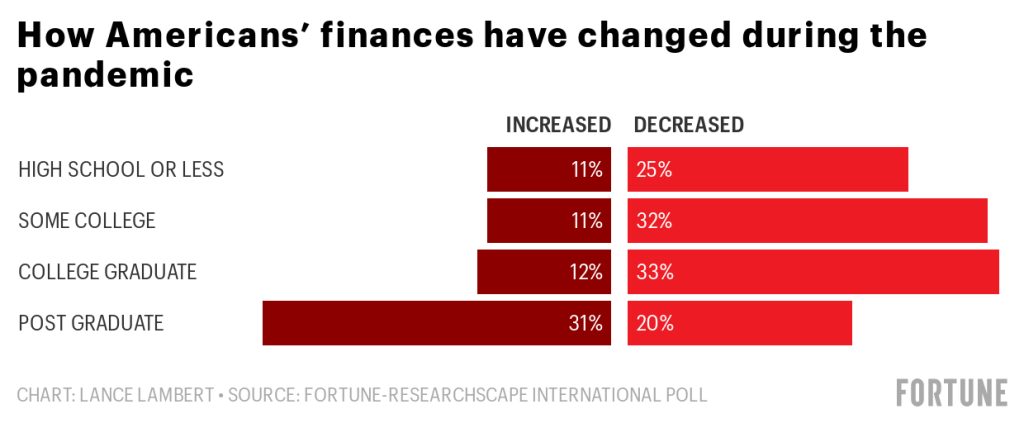

Although some Americans are trying hard to make ends meetothers that have escaped Advances are in fact better off financially since they save money which could have been spent {} , exercising, or even travel. While only 11 percent of U.S. adults having a high school diploma or less–that are far more inclined to operate in areas hardest hit by the pandemic–state they are financially better off today.

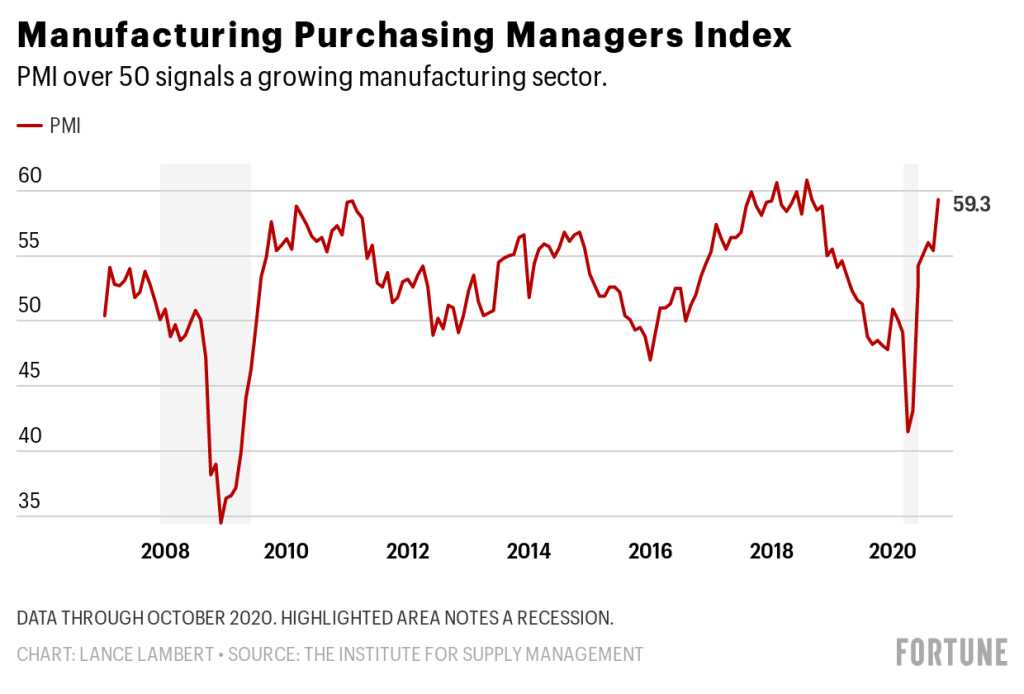

While the terrific Recession hammered fabricating, now round the industry is one of our bright areas. The Institute for Supply Management’s Purchasing Managers Index (PMI) arrived at 59.3 at October, up by the 41.5 underside in April. A PMI under 50 indicates a contracting manufacturing industry, even though a speed more than 50 signals expansion –something we have reached for five successive weeks.

The spring lockdowns closed several factories, which resulted in widespread shortages. In the long run, producers are busy making up to all those shortfalls.

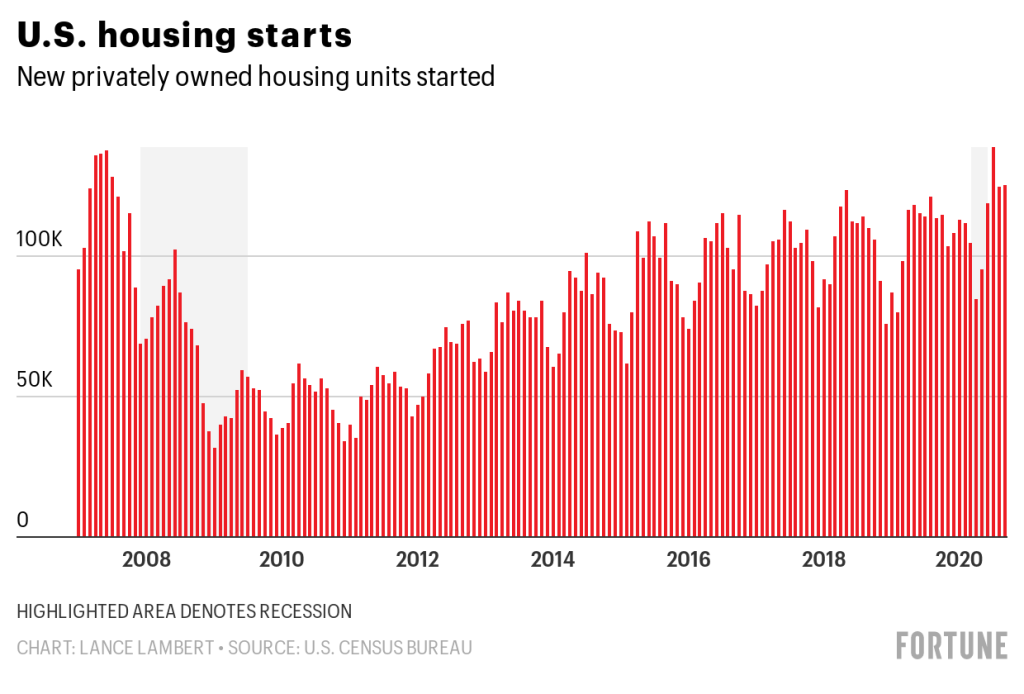

The previous time homebuilders were that this active George W. Bush was at the White House. In general, construction crews began running around 1.4 million brand new houses in September, up 11 percent in the year before. The rally in homebuilding is so powerful {} worsened the federal lumber deficit; for a time lumber costs totaled 130 percent .

How do housing be {} ? For starters the industry was aided by decreasing interest rates, a listing stock exchange , and rich town dwellers purchasing second houses. The greatest years for millennial births ranged from 1989 to 1993. And we are now amid the {} when all these youthful millennials will reach their dignity –that the peak years to get homebuying. That dash of millennials to the current marketplace is causing property to push up.

In general, economic information is helpful to piece together a narrative about the market. What is this you telling us? It is quite a story of two recoveries where some individuals, careers, and geographical areas have recovered quickly (or not felt a lot of pain at the first place), whereas some have been still mired in a very long slog, attempting to recapture the profits so quickly dropped to a fatal pandemic.

- Currently Pfizer is your vaccine front-runner, if you purchase the inventory ?

- Can another $1,200 stimulation check come? Here is what we understand

- By mentorship to friendship love: Everything I heard from three investment giants

- J.P. Morgan analysts predict those 25 shares “brief” applicants for a COVID vaccine has nearer

- A journalist-turned-detective about how corporate America is determined by personal sleuths