That is the internet edition of this Bull Sheet,” Fortune’s no-BS daily newsletter about the markets. Subscribe to get it from your inbox .

Superior morning. International stocks and U.S. stocks are sliding all early as COVID concerns spook traders. Everything else appears to be secondary, such as a heap of earnings beats which traders are mostly dismissing, and also, in some instances, are penalizing.

Allow ’s view exactly what ’therefore moving the markets.

Market upgrade

Asia

- The most Significant Asia indicators are largely lower in day trading together using all the Hang Seng down almost 0.6percent .

- Jack Ma’s Ant Group expects to increase about $34.5 billion in its own impending record-breaking IPO. The fintech giant hopes to start trading next week at Shanghai and Hong Kong, which fund-raising bonanza will create Ma that the 11th richest man on Earth .

- A few promising news on the COVID vaccine leading … CanSino Biologics co-founder Yu Xuefeng revealed the Chinese medicine business is on schedule to complete its single-dose Stage III COVID vaccine trials in January, 2022. He also made the comments Tuesday in the Fortune International Forum.

Europe

- The European bourses are at the red using all the Europe Stoxx 600 down almost 0.30percent as investors worry over the impact of COVID limitations Throughout the country. Since we’ve been visiting all earnings year, adequate corporate outcomes are getting drowned out by the virus information. Stocks in HSBC climbed up to since 5.3percent at Hong Kong this afternoon following the bank reported that a bottom-line beat and, even more to the point, proposed it’so prepared to resume dividend payments.

- BP eked out a slender Q3 operating profit this afternoon, which sums to a gigantic beat for Big Oil nowadays. However, its bottom line outcome comes at a whopping 96 percent under the year earlier quarter. Shares grew up 1.7percent in the start, prior to climbing.

U.S.

- U.S. stocks are investing this afternoon. This ’s following all 3 trades bombed on Monday, the worst fall in per month. Even the Dow’s Monday declines were sufficient to place the benchmark indicator in the red for October.

- BlackRock is brief the dollar entering the election. The planet’s largest money manager considers that the greenback has farther to fall irrespective of which party has been at the White House next year.

- Which firms are about the reporting calendar now?

- The buck is level.

- Crude is upward, together using Brent trading in baseline over $41/barrel.

***

Eat your own beats

As I noticed within this area a week, the holy “conquer ” is no more shifting shareholders.

There are exceptions, especially with BP and HSBC now. (The latter would be assisted by its own dividend statement, yet.) However, it’s not a given that stocks will leap when firms reevaluate the consensus quote on the upper – or bottom line.

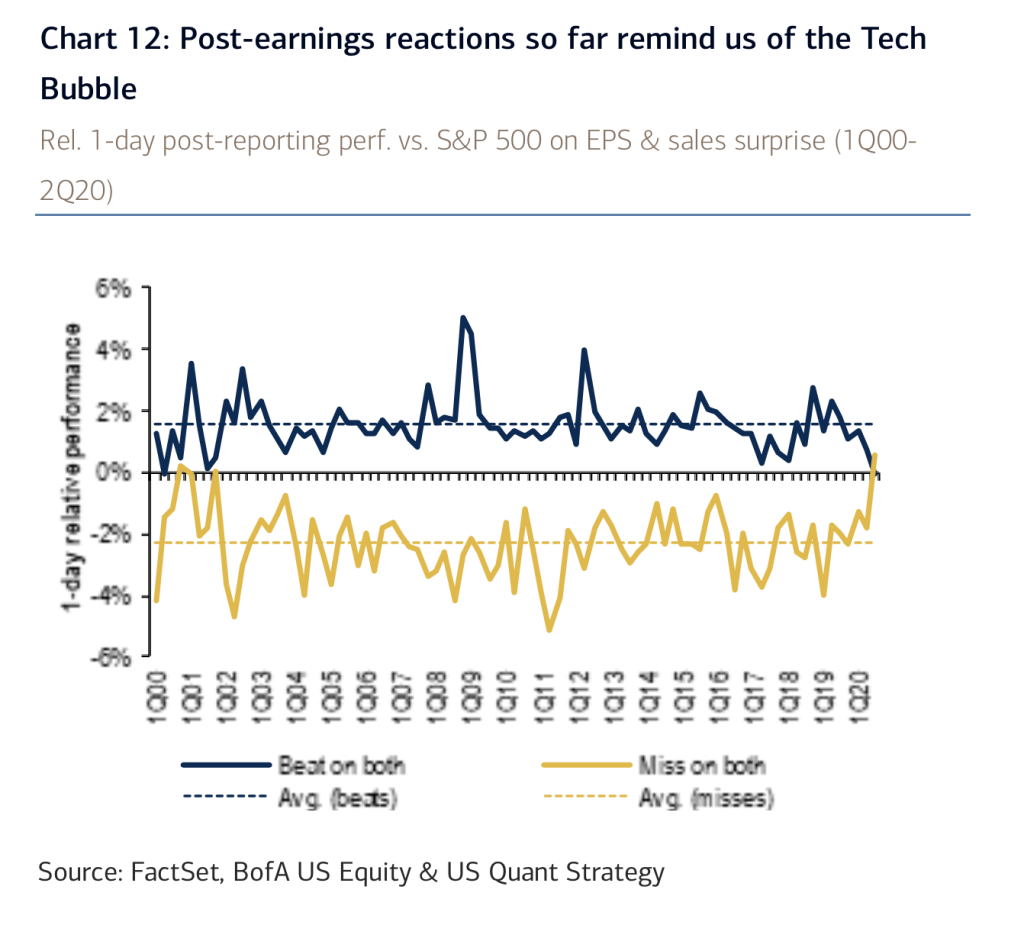

As my buddy Anne Sraders reported , this tendency has gone to an extreme. She estimates BofA Securities who compose in a Monday agent notice, “So far this past year, businesses which conquer both the top and bottom line have underperformed that the S&P 500 by 5bps the afternoon following (worst in background ), also overlooks outperformed by 60bps, maximum in history. ”

There’s some precedent for this particular bizzarro happening –that the technology bubble of 2000, that was “the sole earnings season ever when surprises found significant as opposed to instinctive reactions–beats weren’t rewarded and misses weren’t penalized. ”

This up-is-down response comes as employers are with an astonishing quarter, beats-wise. Sraders breaks down how amazing .

Now, the actual test with this tendency stems this week since the firms reporting on these five times represent almost 40 percent of their S&P 500’s mixed earnings.

To put it differently, if the tendency still holds true that this time this is something to see over the upcoming quarters also.

***

Have a wonderful day, everybody. I’ll visit you tomorrow.

Bernhard Warner

@BernhardWarner

[email protected]