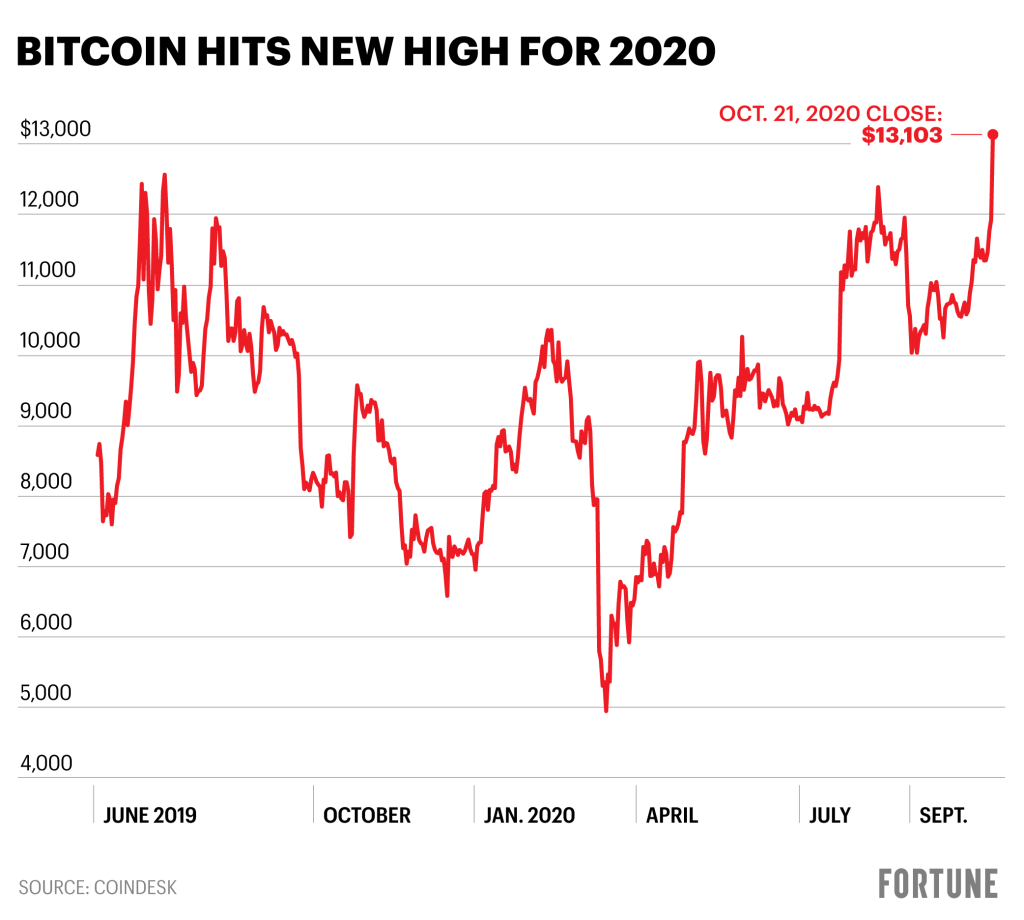

The most recent spike has come as a member of a bull run pushed in part with votes of confidence in a number of the nation ’s largest financial businesses.

On Wednesday afternoon, PayPal declared it’d let users purchase a small number of cryptocurrencies, such as Ethereum along with Bitcoin, resulting in the cost of the latter to grow near $13,200.

The PayPal statement came 2 weeks after repayment giant Square declared that it was adding $50 million value of Bitcoin for its balance sheet for a long-term investment, and just two weeks later after another publicly traded firm, Microstrategy, created a $250 million Bitcoin buy.

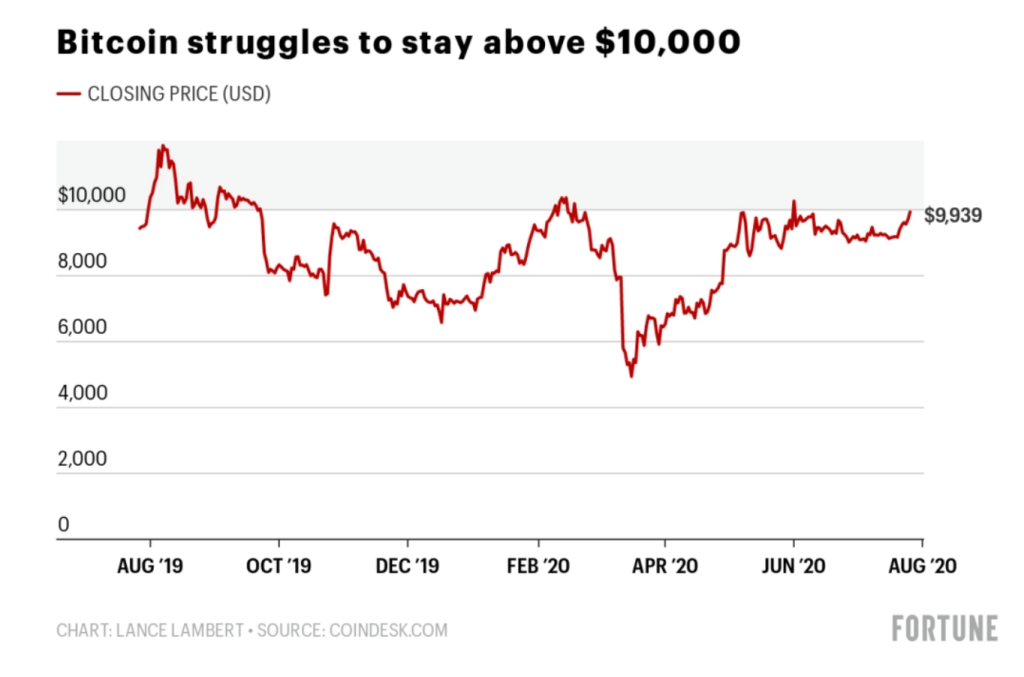

The upshot is your cryptocurrency’s greatest series of cost performance within a season:

The bull run for Bitcoin can be noteworthy since it has witnessed the cryptocurrency float around the crucial emotional markers of $10,000 to get a listing 85 successive days. While Bitcoin cautioned that mark many times before –most especially throughout the crypto bubble of overdue 2017 if the cost brushed its all-time high of $20,000–it’s {} under $10,000 only a couple of days or months afterwards.

Bitcoin is famously volatile (though much less than through its first days), and it’s frequently tough to determine single elements that describe price swings. Although this week’s {} was nearly surely surpassed in large part from the PayPal news, there might be other tailwinds forcing the cost up.

Those tailwinds incorporate a boom at lesser understood cryptocurrencies the summertime, which directed several dealers to cash out and throw their gains into Bitcoin. At exactly the exact identical period, long-time Bitcoin bulls assert the cryptocurrency has turned into a substitute for gold among people trying to find a safe haven advantage amid times of chaos and loose fiscal policy.

Much more must-read tech policy out of Fortune:

- Everything Silicon Valley wants in the 2020 election

- Underneath property’s surprise 2020 flourish and that which comes following

- Google states it is not a harmful monopoly. Listed below are some 4 important disagreements

- Which might alter at Google when the Department of Justice has its method

- Teledentistry is filling a pit left by the pandemic, however some warning it can not replace on-the-go visits