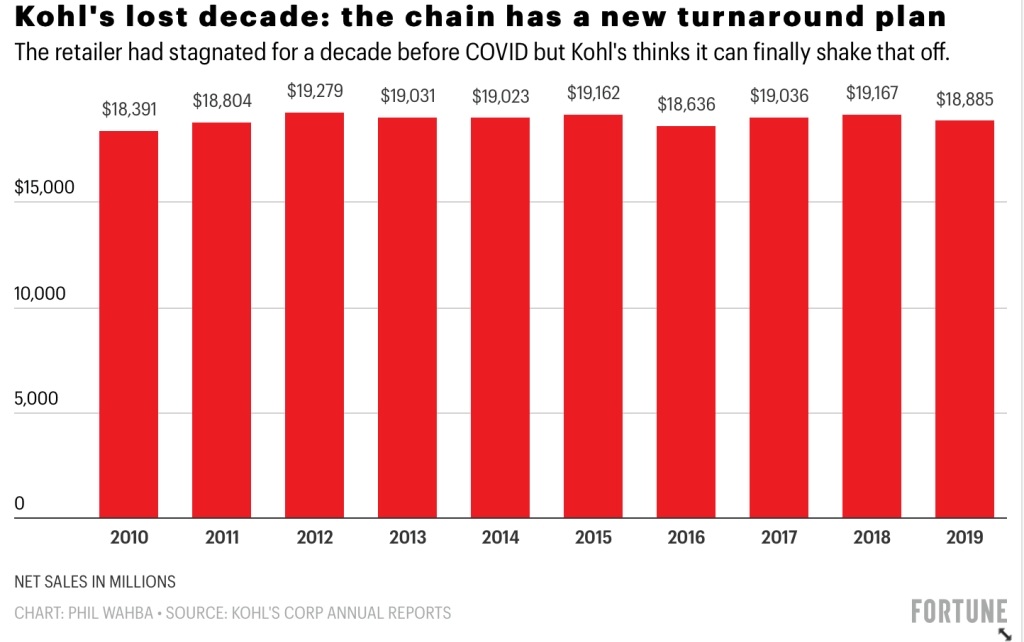

On the eve of this pandemic’s epidemic in mid-March, Kohl’s needed a new turnaround strategy it needed to unveil to Wall Street that it expected would eventually shake decades of stagnation.

However, the COVID-19 epidemic, that compelled Kohl’s to shut its shops for months , thwarted these plans, rather putting the merchant in survival manner as earnings fell 33 percent from the first half of their financial year.

Now that company has stabilized{} far from coming into pre-pandemic amounts –Kohl’therefore is unveiling its own plan, which changes it away from style, where it’s stumbled, and farther into activewear. The program also requires Kohl’so to lean more heavily on domestic brands such as Nike and TOMS, in addition to newer partners such as Lands’ side and Cole Haan, also drop a number of its store brands.

“The Kohl’s shop and manufacturer will appear and feel different,” Kohl’s CEO Michelle Gass informs Fortune. “Lively and casual are likely to be in the middle of this. ”

Clothes spending has been among the largest offenders of this pandemic. Shielding Kohl’s out of the worst of these clothes armageddon buffeting other department stores and specialty apparel chains is activewear from manufacturers such as Nike, Under Armour, along with Adidas. Kohl’s {} put a significant bet on sporty clothing following Gass combined Kohl’so in 2013. That class now generates 20 percent of Kohl’s earnings and Gass believes that can reach 30 percent.

While COVID-19 chose a hammer into the company of several Kohl’s competitions — especially bankrupting mall-based J.C. Penney and decimating Macy’s–additional competitions have fared considerably better, adding to the strain Kohl’s to eventually contact growth.

Having 95 percent of shops apart from malls helped it to prevent from a lot of their ravages sensed by Penney and Macy’s. Nevertheless as a strip-mall based series, Kohl’therefore is moving up against really powerful rivals in Goal , Ulta Beauty, Dick’s Sporting Goods along with T.J. Maxx.

Gap Inc’s Old Navy series, that competes with Kohl’s to its work of youthful American moms, among other demographics, also saw a revenue decline much more compact than Kohl’therefore, whilst Target reported a rise in clothing and home merchandise sales.

And that has compelled Kohl’so to rethink its product strategy and making it attractive to shoppers. Even though Kohl’s isn’t independently at selling athleisure, it’s carved a niche by focusing on these things for the entire family instead of only girls. “We can have that distance,” states Gass. Kohl’therefore is testing new ideas, such as personal care goods, in 50 shops. “It might or might not work–we are actually extending the bounds of where we could go and choose this casual and active way of life,” Gass adds.

For decades, Kohl’s wager heavily on shop brands, which provide greater profit margins, even more management, and something customers need –but may ’t buy elsewhere. Kohl’s difficulty is that too a lot of its shop brands grew rancid, especially in apparel. This weakness stands in stark contrast to Target’s outstanding capability to swiftly start new brands that deliver customers flocking.

Kohl’s has thus far dropped eight of its own exclusive brands, such as JLO, Rock & Republic and Dana Buchman, using much more exits to emerge, even as it’s lined up more domestic brands, such as Lands’ side and Cole Haan. The merchant currently gets 37 percent of earnings from its {own {}|own} brands in clothing as well as other classes, down from over half only a couple of decades back. “We’ll be more concentrated,” Gass mentioned of this paring of manufacturers.

Beauty telephone

Kohl’s was striving for a long time to turn into a significant participant in the beauty industry following ceded it into Macy’s and J.C. Penney, that homes Sephora stores. In actuality, establishing a large attractiveness was that a linchpin of Kohl’s “Greatness Agenda” at 2014, together with the company expecting beauty would increase from 2 percent of earnings then to 5 percent within short order, aided by so-called “attractiveness concierges. ” While Kohl’s has revealed strength in aroma, beauty hasn’t afforded the upside down the company planned, since it has faced stiff competition from strip mall acquaintances Target and Ulta Beauty, also to some lesser scope CVS along with Walgreens.

Kohl’therefore is currently planning beauty stores twice the size of its own existing ones, staffed by attractiveness consultants. The class is essential to solving a riddle that’s bedeviled Kohl’therefore for many years: how to acquire more shoppers to visit shop and indulge, instead of simply popping to the shop to get a fast in-and-out excursion.

A major portion of its strategy is to continue building its e-commerce enterprise. Online shopping, that accounted for almost a quarter of earnings pre-pandemic, spiked to up to 40% in the summit of this pandemic. Finally, it’therefore anticipated to settle somewhere in the midst of these two percentages.

In-store,” Kohl’therefore will lower its variety in a few brands as far as 40 percent. It’ll shrink its supply of purses, jewelry, fine jewelry, and guys ’s matches –regions which have seen sales decrease –creating space to improve inventory of healthy categories.

“This provides us the flexibility to lean into expansion classes, evaluation, understand, iterate–kill what is not functioning, scale what’s,” states Gass. And {} yield that long-term growth.